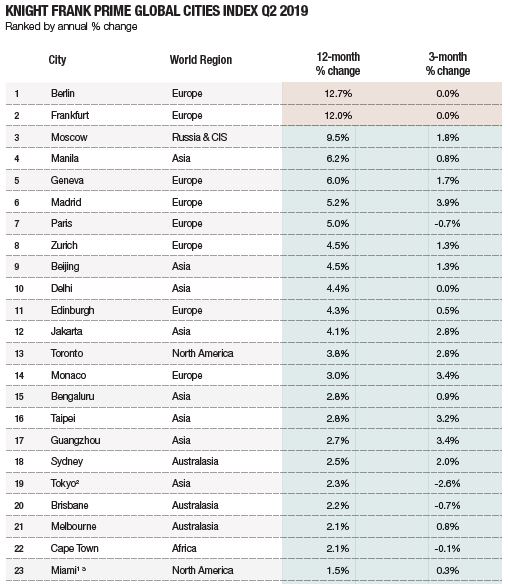

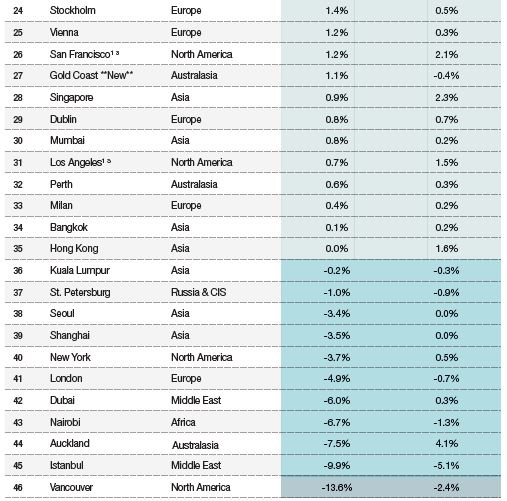

International Property - Prime Global Cities Index Q2 2019

PRIME CITIES UPDATE

Mounting economic headwinds are contributing to slower prime price growth and leading policymakers in developed and emerging markets alike to cut interest rates, presenting opportunities for the least risk-averse.

The Prime Global Cities Index, which tracks the movement in luxury residential prices across 46 cities, increased by 1.4% in the year to June 2019, up marginally from 1.3% in March 2019 but still significantly lower than its four-year average of 3.8%.

Although Berlin leads the index, its rate of annual growth has slowed from 14.1% in March 2019 to 12.7% in June 2019. Frankfurt, by comparison, has seen its annual price growth increase from 9.6% to 12.0% over the same period. However, with prime prices in Berlin and Frankfurt currently around €11,500 per sqm and €13,500 per sq m respectively they remain competitive by European standards.

Some 35 of the 46 cities tracked by the index (76%) registered price growth in the year to June 2019. Of the eleven that saw prices decline year-on-year, Istanbul (-9.9%) and Vancouver (-13.6%) were the weakest markets.

Six European cities now sit within the top ten, down from seven last quarter as Edinburgh (4.3%) saw price growth moderate pushing it to 12th place.

Madrid and Paris are following similar paths recording 5.2% and 5.0% annual growth respectively. In both cases, the headline figure conceals variations at a neighbourhood level.

In Madrid, areas such as Chamberí as well as outer non-prime districts are performing strongly. In Paris, the Left Bank, in particular the 6th and 7th arrondissements, are now pausing for breath having witnessed upward of 11% price growth since 2017, whilst the 18th continues its upward trajectory.

In mainland China, tier 1 cities such as Beijing (4.5%) and Guangzhou (2.7%) saw prime price growth strengthen in the first half of 2019 as optimism grew surrounding the potential relaxation of housing policies, even though authorities reiterated their stance against speculation.

In Hong Kong (0%), the opening of various cross-border infrastructure projects, which should boost economic links in the Pearl River Delta over time, failed to counteract immediate concerns over the US/China trade war and political discord.

Singapore’s prime market (0.9%) remains subdued as buyers adjust to the latest round of regulations, yet despite this, a number of record sales prices have been achieved so far in 2019.

Sluggish economic growth explains the wave of interest rate cuts evident in the last three months (Figure 1) as policymakers try to stimulate growth. Much hinges on the next three months with stronger headwinds on the horizon we expect the index to moderate further in the second half of 2019 before strengthening in 2020.

Knight Frank’s Prime Global Cities Index tracks the movement in prime residential prices across 46 cities worldwide using data from our global research network. Compiled quarterly, this is a valuation-based index tracking the top 5% of the housing market in most cities.

Courtesy: Knight Frank

RESEARCH ENQUIRIES

Liam Bailey - Global Head of Research

+44 20 7861 5133

Kate Everett-Allen - International Residential Research

+44 207 167 2497

PRESS OFFICE

Astrid Recaldin

+44 20 7861 1182

Important Notice. © Knight Frank LLP 2019 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.