Investment Portfolios - Best and Most Predictable Returns over the Next Decade

Consumption driven multinational companies are likely to produce among the best and most predictable returns over the next decade.

Question marks over Brexit, Donald Trump and “junk status” mean investors are facing more uncertainty than ever before. Although these issues may impact markets in the short term, it is important not to be distracted by market volatility and lose sight of longer term opportunities. Given this backdrop Marriott highlights: 1) its investment process and how investing in reliable dividend payers helps ensure a more predictable outcome; and, 2) why we believe consumer driven multinational companies are likely to be among the best returning investments over the next decade.

Predictable Returns

At Marriott, we bring more certainty to investing by ensuring consistent and reliable dividend growth from our investments through a security selection process which filters out companies where future dividends are hard to predict. This filtering process minimises a number of uncertainties ensuring all equity investments in the Marriott portfolios deliver reliable and growing dividends into the future, which ultimately translates into predictable capital growth. The charts below illustrate two examples of how a company’s share price grows in line with its dividends over time:

A Business Truth: The value of a business grows over time at the rate at which its profits grow. In the same way, the value of an investment grows over time at the rate at which income grows

Marriott’s security-selection filter is summarised below and shows all the requirements a company must meet in order to be considered for inclusion in a Marriott portfolio.

The companies that have made it through the filtering process are highlighted above. These companies are well established businesses that have strong balance sheets with long track records of paying reliable dividends. They also tend to share five characteristics that help ensure future dividends are secure: 1) fulfil a basic need; 2) strong brands; 3) pricing power; 4) growing markets; and, 5) diversification. The table below illustrates how Nestle and Colgate-Palmolive, two companies which have been able to increase their annual dividends consecutively for more than 25 years, tick all 5 of these boxes:

The future dividend prospects of companies of this nature are largely unaffected by changing economics, politics or technology – all very difficult to predict. More reliable dividend growth means more predictable capital growth and ultimately a more certain outcome for investors.

Good Returns

As well as offering investors a more predictable outcome, Marriott believes the multinationals we include in our portfolios will be among the best returning investments over the next decade as they are well positioned to benefit from two important longer term trends: 1) developing market consumerism; and, 2) technology-enabled efficiencies.

1. Consumerism:

The GDP growth of many major emerging markets is increasingly being driven by household spending as they transition from investment-led to consumption-driven economies. Described as “the biggest growth opportunity in the history of capitalism”, McKinsey & Company estimates that by 2025 annual consumption in developing markets will increase by $18 trillion and account for half of the world’s consumption. This is very positive for the dividend and capital growth prospects of the companies in Marriott’s offshore portfolios due to the following:

- From pet food to nappies, these companies offer goods and services that form an integral part of the daily lives of consumers across the globe.

- They have strong brands that consumers across the world trust. Studies have shown that in Latin America and developing Asia between 60 – 80% of consumers only buy products and services from a trusted brand.

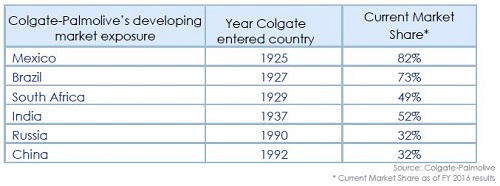

- They also have well-established, strong footholds in developing markets as illustrated by Colgate’s toothpaste market share in the table below:

2. Efficiencies:

The companies that have made it through Marriott’s filtering process are also unlikely to be disrupted by changing technology and therefore stand to be major beneficiaries of innovation in the years ahead. Cisco – a worldwide leader in IT – estimates that automation will produce a bottom line improvement for global businesses of approximately $14 trillion over the next decade; this represents approximately one fifth of current global profits. Widening margins will likely result in more dividend and capital growth from Marriott’s chosen multinationals that already stand to benefit from the rapidly growing consuming class in the developing world.

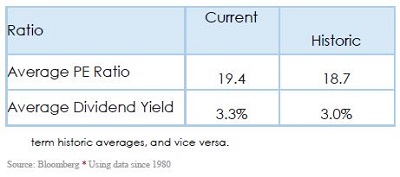

In addition to a favourable growth outlook, the companies we invest in are fairly priced, as illustrated in the table below:

Note: Quality companies – companies we consider to be resilient to changing economics, politics and technology – should always justify higher PE multiples when compared to companies of inferior quality (this is obvious but frequently forgotten). A fairer assessment of value is to compare the current multiples of quality companies against their longer term historic averages, and vice versa.

Source: Bloomberg * Using data since 1980

Conclusion

The consumption driven multinational companies that have made it through Marriott’s investment filtering process are expected to produce reliable dividend growth in the years ahead. Over the longer term, reliable dividend growth means more predictable capital growth which ultimately translates into a more certain outcome for investors.

These companies are fairly priced and are well positioned to benefit from developing market consumerism and technology-enabled efficiencies – two important longer term trends from a dividend and capital growth perspective. Hence Marriott is of the view that consumption driven multinational companies are likely to produce among the best and most predictable returns over the next decade.

This release has been issued on behalf of Marriott, the Income Specialists

For more information, please contact:

Shannon Simpson, Marriott Marketing

Telephone: 031 765 0766 (direct) 031 765 0700 (switchboard)

Shirley Williams Communications

Shirley Williams: 031 564 7700 or 083 303 1663

Gillian Findlay: 082 330 1477 or 011 486 3561

About Marriott, the Income Specialists

Marriott aims to reduce financial anxiety of investors by offering local and international Solutions, using an Income Focused Investment Style which produces reliable and consistent monthly income.