Inside View - Germany 2017

If we look at Berlin specifically:

- It is high demand and low supply which makes Berlin so appealing.

- The city’s population expanded by 40,000 in 2015, and household numbers are forecast to increase by 74,000 between 2015 and 2020.

- Completions however are not keeping pace. Estimates suggest the city needs to build 20,000 new homes each year to satisfy new and pent-up demand. And, although building rates doubled between 2012 and 2015, only 10,722 new homes were brought to the market in 2015.

- Property prices in the city have risen 10% a year for the past five years.

- The city is becoming ever more international and we have seen a surge in enquiries since the start of 2017 from British and US buyers.

- German buyers still account for a large segment within the luxury sector. However, overseas interest has increased and become more diverse. 16% come from the EU (excluding the UK), 14% from China, 14% Switzerland, 13% from the UAE, 9% from the UK and the remainder from Singapore, USA, Israel and others.

- 50,000 people move to Berlin every year. Of these, 75% are aged under 35, drawn by the exciting start-up scene, buzzing nightlife and culture.

- Areas to watch include Mediaspree, Europacity and Potsdamer Platz, where major construction is taking place.

OVERVIEW - A tale of two cities

At a time when the machinations of world politics feel like a rollercoaster ride – one that takes in Britain’s uncertain journey towards Brexit, an unpredictable new era in the US under Trump and the scandals and scare tactics that surround various elections in Europe in 2017 – Germany stands tall as the strong, stable political and economic force in Europe.

By Paddy Dring - Head of the International Residential Department

Eyes are naturally on Germany’s own federal elections in Autumn, particularly in a climate in which ultra-right parties are seizing the spotlight across Europe, but the result is unlikely to throw up major surprises. The two leading parties – Angela Merkel’s CDU (as well as its sister party the CSU) and the centre-left SPD – are politically close, while the far right AfD, an anti-EU party, is failing to gain momentum. Germany’s property market has resisted the overheating and subsequent slowdown seen in other European markets in recent years, and its stability is unlikely to be rocked by the election result.

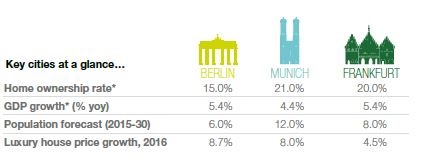

What does remain a phenomenon in Germany’s property market is its low level of home ownership – one of the lowest in Europe. In Berlin, 15% of the population own their home; in Munich, 21%. Renting is a social and cultural norm, but also a financial imperative for a growing number of young Germans.

For Sale - UPSIDE Berlin

Foreign buyers, however, are fuelling demand for property in Berlin, where they account for 20-25% of its market today. Property prices have risen by about 10% a year for the past five years, the city is becoming ever more international and we have noticed a surge in enquiries since the start of 2017 from British and US buyers. Of the 50,000 people who move to Berlin each year, 75% are aged under 35, drawn by the exciting start-up scene, buzzing nightlife and culture.

Such population growth puts pressure on the existing housing stock - Berlin needs 20,000 new units a year and currently builds 10,722 – but there is land aplenty. Major areas of new construction include Mediaspree, the huge new telecommunications and media hub that spans both banks of the river Spree and is home to headquarters belonging to Coca Cola and the German online giant Zalando. Europacity, a new 40-hectare quarter around Berlin’s main train station, and the redeveloped Potsdamer Platz are similarly revitalising the city centre, leading empty-nesters to swap their suburban detached homes for central apartments.

In Munich, the population is also on the rise but the market is largely domestic, either from within the city or elsewhere in Germany. The 20,000 newcomers to Munich each year - a significant addition to a population of 1.5 million – are invariably wealthy and welleducated, often working for IT companies such as Google or Microsoft or business owners who relocate for the high quality of life.

Their preferred addresses are in the old town, in genteel Lehel or Schwabing, vibrant Glockenbachviertel or the museum quarter of Maxvorstadt. They want to walk home from the opera, spend weekends by the lakes and be within easy reach of Italy and the Swiss Alps. Budget is not a concern; their purchase is all about location. But almost all of Munich’s 7,000-10,000 new builds each year are located on the outskirts, with virtually no scope for new city centre development.

Munich’s high demand and constrained supply has led to much talk of a price bubble. Property prices have doubled in the last decade and rents have struggled to keep up. But while we can’t expect to see property prices continuing to rise at 10% a year, we predict a flat-lining of prices for the next two or three years, not a bubble bursting.

A burgeoning population demands new, improved infrastructure – and Munich’s major projects that are underway or planned include a new €3.84bn underground line that runs east to west below the city centre, and tunnels beneath the congested Middle Ring Road, one of the busiest roads in Europe.

In different ways, Berlin and Munich could be seen as big construction sites – the first awash with new residential and mixed-use development, the latter beefing up its infrastructure to cater to the growing population’s new demands. What both cities inspire is confidence. While the world’s rollercoaster hurtles past, these German stalwarts provide reassuringly firm ground.

Lock up and leave luxury in Berlin

Berlin in the early 1980s bore little relation to the vibrant, cutting edge and cosmopolitan city it is today. But then, as now, one of Berlin’s biggest property developers, Jürgen Leibfried, spotted the opportunity to do something new.

By Zoe Dare Hall

When Dr. Leibfried, fresh from his university studies in Munich, founded the property company Bauwert in 1983 and began buying and selling property mainly in the “traditional, established” area of Friedenau, it was a niche market to say the least. “There were some investors attracted by big tax breaks, but normal Berliners were not interested in buying because it was so cheap to rent due to the rent controls introduced in the 1970s,” he says. “Berlin was a completely different city in those days and West Berlin was effectively an island in the Soviet-run GDR.”

Am Hochmeisterplatz

Many expected the city to boom when the wall fell in 1989, “but it is a young city. It needed time to develop its own spirit and culture,” says Dr. Leibfried. For some years, more people left the city than moved in. Now, there are 50,000 new arrivals a year and Bauwert has notched up more than 300 projects, worth €5bn, in Berlin.

“It’s the place to be for young people. It is still cheap compared with international cities such as London and Paris and other German cities such as Hamburg and Munich,” says Dr. Leibfried, who for 20 years commuted between Munich and Berlin, but now calls Berlin home.

The level of home ownership in Berlin is still low at 15%, but it’s on the rise, fuelled by demand from overseas investors and rising house prices. “Rents are going up too, so Berlin offers better investment potential, and new developments – which is what we focus on – are exempt from the rent control laws,” says Dr. Leibfried. “Berlin is a mid to long-term investment,” he adds. “It offers the potential for attractive margins as prices are starting from a low base and any risk is tempered by a high level of transparency and good governance.”

What Berlin lacks, however, is a good supply of modern flats of good quality. “It’s a big city with lots of stock, but very little of any quality was built from the 1960s to the 1980s,” says Dr. Leibfried. “The biggest part of our housing stock is prefab buildings in the eastern part of Berlin and public housing in the west, which do not meet the demands of many buyers today, and there is not enough new development still. The Government is very tenant-orientated and it is difficult to get building permission.”

Given Bauwert’s track record, Dr. Leibfried and his partner Mr. Staudinger have clearly found the key. Their projects – typically of around 20 apartments – focus on well-established areas such as Kreuzberg, Ku’Damm, Mitte and Charlottenburg: “micro areas”, as he calls them, with good shops, restaurants and public transport.

Bauwert’s latest project, Am Hochmeisterplatz, has such a prized location, on one of the last remaining buildable sites just 150 meters from the Kurfürstendamm – the famous boulevard known as the Champs Elysées of Berlin. The building, which overlooks the green expanse of Hochmeisterplatz park, also brings a new type of product to the city.

Externally, the development has the patina of the elegant, turn of the century buildings that characterise this Charlottenburg area of Western Berlin. “It will be reminiscent of Berlin’s great townhouses. You will walk around and say ‘what a wonderfully restored building’, but it is 100% new, inspired by the traditional style of Paris and Vienna,” says Dr. Leibfried.

Inside, it offers the kind of modern, luxurious lock up and leave lifestyle that is still hard to find in the German capital. The apartments, with one to six bedrooms and priced from around €400,000 to €3.4m for the penthouses, variously come with balconies, gardens, rooftop terraces and loggias. There are Fendi Casa and Trussardi Casa fixtures and fittings, and an interior design service available to owners.

As a passionate art collector, Dr. Leibfried is also keen to make art a key part of this project, including with one-off works in the communal foyers by the Berlin-based sculptor Robert Metzkes.

“More and more galleries are opening in this area and I like to bring a connection between property buyers and artists,” he says. “Home-owners in the 18th and 19th centuries used to represent artists on the walls and we should do it in this century, making art a part of the building.”

This new product is likely to appeal to a new type of buyer that Dr. Leibfried has spotted. “They are aged 55-60, have a nice house, play golf, but they want the buzz of the city centre – the top restaurants, galleries, theatre. Maybe 10 or 20 years ago, buyers of this age would have wanted to slow down. Now they want to be connected to all of that.”

There is perhaps no one better to bring them that lifestyle than Jürgen Leibfried, a man who has watched Berlin grow and change around him over the decades.

The safest of havens?

Germany’s key cities have been on the radar of global investors for more than a decade but their appeal goes beyond just firm economic fundamentals.

By Kate Everett-Allen

Germany’s top cities have been well-placed to benefit from capital flows at times of economic and political turbulence over the last decade. Investors from southern Europe shifted their assets northwards during the Eurozone debt crisis, Asian and US investors looked to Germany when returns in their own markets started to diminish and now Brexit sees Germany’s key cities back under the spotlight. But what makes Germany’s top cities so appealing for foreign investors?

The simple answer is high demand and low supply. Using Berlin as an example, the city’s population expanded by 40,000 in 2015, and household numbers are forecast to increase by 74,000 between 2015 and 2020.

Completions, however, are not keeping pace. Estimates suggest the city needs to build 20,000 new homes each year to satisfy new and pent-up demand and although building rates almost doubled between 2012 and 2015, only 10,722 new homes were brought to the market in 2015.

Aside from the economic fundamentals, Germany’s cities still have some of the lowest home ownership rates in the world. Numbers are rising, in part due to the ECB’s historically low interest rates, but with only 15% of home classified as owner-occupied, landlords in Berlin rarely struggle with lengthy void periods. Add to this the vibrant technology and start-up industries in the city which together are attracting a younger, entrepreneurial generation and Berlin’s credentials are self-evident.

Delve deeper though and there is more to Berlin’s appeal than just demand, supply and good economics. Numerous safeguards have been put in place – partly to avoid a repetition of the boomand bust scenario seen in the late nineties and partly to ensure housing remains affordable for local residents.

Mortgage lending is now highly regulated. Capital gains tax is charged on all properties sold within two years of purchase, or in the case of buy-to-let homes, 10 years, to discourage speculation. Berlin has also gone one step further than other German cities by introducing a new rent cap which, means that the rent specified in a new tenant contract cannot exceed the local average by more than 10%.

But far from deterred by such stringent regulations, landlords and investors instead see the measures as pillars of support which help bolster market confidence and minimise risk.

The introduction of a permit system for short-term rentals via Airbnb and the designation of 33 neighbourhoods as “urban conservation areas” where owners are prevented from converting their rental properties to luxury condominiums to sell on, reinforces again the council’s commitment to the city’s rental sector but at the same time constrains the supply of homes available to purchase.

Luxury living

Analysis of sales by price band highlights the extent to which Berlin’s largely nascent luxury residential market has shifted gear over the last five years. In 2011, 18 sales were completed above €7,500 per sq m, but by 2016 this figure had jumped to 80 transactions. Although not on a par with global cities such as London and New York, the city’s superprime market, which we define as sales exceeding €10,000 per sqm, is also expanding with sales up from five to 18 in the last five years.

Who’s buying?

Data from our partners in Berlin, Ziegert Immobilien, shows that whilst German buyers still account for a large segment of demand within the luxury sector, overseas interest not only increased but became more diverse. European buyers continue to represent a key component of demand but buyers from China, the US and the Middle East together accounted for more than 42% of sales to overseas buyers in 2016, a trend we expect to continue throughout 2017.

Source: Ziegert, Knight Frank Research

The purchase of real estate in Germany

A Berlin Focus

This guide refers specifically to buying property in Berlin, for other locations please seek alternative advice. We would always recommend that you engage the services of a reputable agent who can assist with understanding the tax and legal structure, finding a suitable financial institution and eventually managing your property investment.

The legalities of buying new build property in Berlin

Reservation

If the buyer needs some time to think about their offer or seekadvice from a third party, the buyer can reserve the property for up to four weeks. The non-refundable charge for this service is 0.3% of the purchase price and will be deducted from the estate agent’s fee.

General power of attorney

By signing a power of attorney authorisation relating to the property, through an independent solicitor, the latter can subsequently act as the buyer’s representative in all legal matters and as authorised recipient. After this, the real purchasing process can begin.

Draft contract

A draft contract will be sent to the buyer for checking. According to German law, the draft contract can be signed after the fifteenth day from receipt. The finished contract is then signed at a later date in the presence of a notary.

Confirmation of finances

International clients can finance their real estate easily using a German institution. Once confirmation of finances has been received, an appointment with a notary is arranged. For further information on comprehensive and independent financial packages please contact us.

Appointment with notary

In accordance with German law, a contract of sale for a property must be certified by a notary and the seller and buyer (or their authorised representative) must sign the documents in the presence of the notary. If the buyer attends in person, an advisor from the real estate agency will stay throughout the appointment. If requested, a specialist interpreter may be consulted.

Purchase

If the property the buyer wishes to purchase is still under construction, the buyer’s real estate advisor will lead them stepby- step through the rest of the process up to its completion. This includes, for example, paying in instalments of the purchase price which corresponds to the progress of the construction works and in accordance with the MaBV—the regulations governing estate agents and property developers (see below).

MaBV—regulations governing estate agents and property developers

These regulations serve to protect the buyer’s asset interests when they purchase a property. Amongst other things, they regulate the conditions under which the seller can demand that the buyer pay the purchase price as a lump sum or in specified instalments.

Advantages for the buyer:

- The seller/property developer is only permitted to receive money from the buyer when a valid contract exists

- The seller/property developer is only permitted to receive money when planning permission has been given

- The money received may only be used for the project

- The money received must be held strictly separate from the private assets of the buyer/ property developer

- Payments must correspond to progress of construction work

Purchasing costs

When purchasing a property in Berlin, the buyer bears the additional costs. This includes:

- Property transfer tax, 6 % of the purchase price in Berlin

- Notary costs around 1% to 1.5 %

- Registry charges for property, approximately 0.5 % of the purchase price

- Estate agent’s commission, approximately 5.95 % incl. VAT.

The commission is payable after signing the purchase contract. The purchase price and the property transfer tax are to be paid after noting the transferral of ownership in the registry. Only once these sums are paid will the apartment be recorded as the property of the buyer in the registry.

Handover

Once the property is built and the last purchasing stages have been completed, the final handover takes place. This concludes the purchasing process.

Courtesy: Knight Frank

The Berlin Team

The London team works closely with our network of local experts in Germany. Our local agents have been carefully selected for their integrity, experience and professionalism and speak English as well as German.

London

Berlin Sales

PADDY DRING - Head of the International Residential Department

+44 20 7861 1061

CLAIRE LOCKE - International Developments Executive

+44 20 7861 5033

Munich Sales

ALEX KOCH DE GOOREYND

+44 20 7861 1109

CAROLINE LAKE - Personal Assistant

+44 20 7861 1055

Research

KATE EVERETT-ALLEN - International Research

+44 20 7861 2497

ASTRID ETCHELLS - International PR

+44 20 7861 1182

Frankfurt

ELVIN DURAKOVIC - Managing Partner

Knight Frank Frankfurt

+49 69 55663366

Berlin

Berlin Business Enquiries

SVEN HENKES

+49 30 880353837

Berlin Sales

ALEXANDER VON ALBERT

+49 30 880353649

Berlin Research & Press Enquiries

DOROTHEA METASCH

+49 30 880353670

Important Notice

© Knight Frank LLP 2017 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.