Property Watch (Part I) - Valuation of Commercial and Industrial Property

PART I - INTRODUCTION

An accepted definition for arriving at the market value of fixed property is:

“the estimated amount for which an asset should exchange between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion”.

In order to arrive at the estimated amount a commonly accepted method is to use the capitalized value of the net income minus all expenses in year 1 in combination with comparative sale prices of the same or similar properties.

Buyers broadly speaking fall into two categories, the valuation considerations would however be the same for both.

The first would be a purchaser who intends to work from a suitably located property that he owns rather than paying rent whether it be an office, industrial, retail or commercial building. The owner/occupiers main concerns, a property suitable for his business at a price he can afford considering his available cash resources and, if he intend borrowing some or all of the purchase price, the affordability of the monthly mortgage costs and property related expenses.

A potential owner/occupier will also compare a new build with an existing building. Buying an existing property, taking occupation could take 3-6 months, buying land, and building could take from 12-24 months.

The second is an investor who needs, not necessarily in order of importance:

- A long term investment that will provide a regular, secure income;

- With expectations of an acceptable return and capital growth;

- From a financially secure tenant with a suitably structured lease;

- In a low maintenance, non-specialised building in a good location.

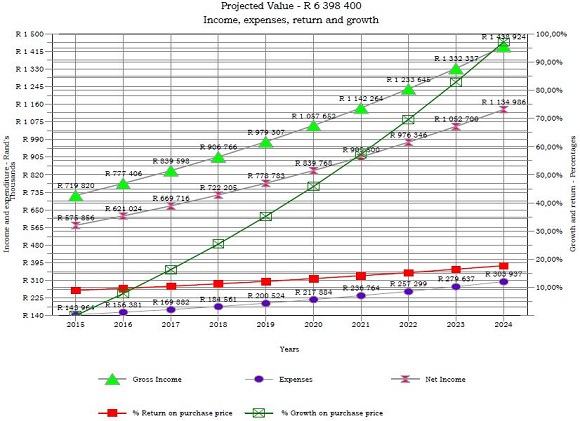

The figures in the attached spreadsheet and graphs throughout the various chapters apply a standard method of estimating the value of a property based on the first year’s net income.

We assumed a building with a lettable area , GLA, of 1 333m² rented at market related rentals of R 45 m², and deducted expenses calculated at 20% of gross income, which equates to R 9m². The first years net income capitalized at 9%, an estimated value of R 6 398 400.

Ownership entities, for both the investor and owner/occupier other than the usual, company, trusts, partnerships etc. are available with the buying entity suitably structured to maximise the buyer’s investment and tax requirements.

* Companies, Close Corporations (CC’s will soon no longer be available) and Trusts, the commonly used method for holding the majority of commercial property investments. Marketability not as good as any of the listed entities.

* Fractional ownership - The purchase of a time based share.

* Partnerships - Not the usual vehicle for commercial property and used when a company, close corporation or trust is not practical.

* Property syndications - The purchase of a share and linked loan account in a property company or close corporation. This alternative has fallen out of favour because of a number of syndication failures. Marketability of shares and linked loan accounts a major drawback.

* Property unit trusts - Listed on the JSE and controlled by the same laws that regulates all unit trusts, The Collective Investment Schemes Control Act. Easily marketable. Income taxed as interest.

* Listed property companies - Listed on the JSE, the same principle as any other listed share. Easily marketable.

* Property Loan Stock Companies - Listed on the JSE, subject to the Companies Act. Invest solely in property. Investors buy a linked unit consisting of a share and a debenture (loan). The debenture portion earns interest. Easily marketable.

* Exchange Traded Funds (ETF) Invests in the top 20 listed commercial stocks.

Cheaper to invest in an EFT than in each of the stocks that it holds. Easily marketable.

Courtesy: Reg Wall

Contact: Reg Wall

Tel: 021 797 2552 / 083 261 0563

Email: [email protected]

Web: www.coreproperty.co.za

Disclaimer: The information in this email is confidential and legally privileged. It is intended solely for the addressee. If you are not the intended recipient, please delete the email. You may not copy, distribute, or disclose the included information to anyone. Whilst all reasonable steps have been taken to ensure the accuracy and integrity of all data transmitted electronically, Christies Property Brokers cc t/a Core Property Group and its subsidiaries do not accept liability if the data, for whatever reason, is corrupt or does not reach its intended destination. No representation or warranty, expressed or implied, is or will be made and no responsibility or liability is or will be accepted by Christies Property Brokers cc t/a Core Property Group, or its subsidiaries, employees, or agents in relation to the accuracy, completeness or fitness for any purpose of this information or for any loss, liability, damage (whether direct or consequential) or expense of any nature whatsoever which may be suffered as a result of or which may be attributable, directly or indirectly, to the use of or reliance upon any of this information. Past performance is not a reliable indicator of future results. The information stated, opinions expressed and estimates given are subject to change without prior notice. This information is for informative purposes only and does not constitute investment advice or any other advice, or a personal recommendation. All aspects of any transaction would need to be reviewed by the client’s preferred advisor prior to implementation. E.O.E