Inside View - Monaco 2016

Monaco Market Overview

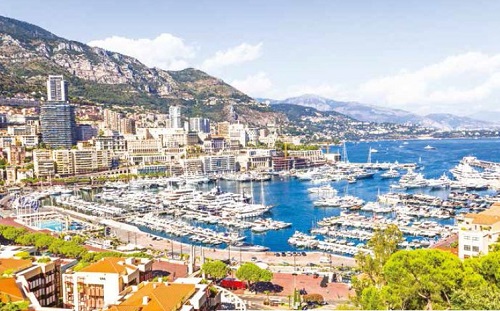

Monaco enjoys a history that can be traced back to the ancient Greeks and a reputation that is global. And yet, in many ways, it is the most modern and mysterious of places.

It has the glamour, energy and house price growth (approximately 10% in 2015) of a major city, but at just 2 sq km in size, Monaco is smaller than the City of London, with four times the resident population.

It is a tax haven, the reason that many of the world’s super rich seek residency in Monaco, but unlike many other tax havens, it is neither remote nor compromised on its lifestyle offering. Monaco is, after all, located on the most sought-after coast in the Mediterranean, with the Cote d’Azur and the Italian Riviera on its doorstep, ski resorts an hour away and Nice airport with connections to Europe and beyond and within approximately a 30 minute drive (or a quick hop by helicopter).

The other anomaly of Monaco is its housing stock. Property prices are among the highest in the world, with its super-prime now touching €100,000 per sq m. €1m will buy you fewer square metres in Monaco than in any other city; just 20 sqm, compared with 23 sq m in Hong Kong, 27 sq m in London, 30 sq m in New York.

However for Ultra High Net Worth buyers familiar with these world cities – who are precisely the kinds of people who will be looking at Monaco with a view to taking residence there – there is still a mismatch between their expectations and the reality of property in Monaco.

Much was built between the 1950s and 1970s and, in many cases, has seen little modernisation since. So prepare for some marble floors in a blaze of pink or orange. Historically, buyers in Monaco have left these interiors in their original state, mainly because they may be wealthy, but they have little time to dedicate to home improvement.

But now buyers are beginning to rip out the old interiors and start again. This is driven by the desire to have a Monaco property of a similar design specification to their homes elsewhere, and doubtless by the influence of new developments such as Tour Odéon, which has brought a new level of design and build quality to Monaco.

Square footage and outdoor space will still be lacking, compared with what you could buy elsewhere on the Riviera. But Monaco’s high-end, high rise homes are starting to become about more than a handy location and breathtaking views; they are beginning to show charm from within too.

We should not forget, either, that many ultra-wealthy individuals choose to rent rather than buy in Monaco. They are still entitled to residency and can enjoy all the perks of Monaco’s soughtafter microclimate and lifestyle, along with the comfort of being surrounded by likeminded people of similar financial means. However by renting they have greater flexibility or may simply find that the property they most fancy – in a principality where land and housing are in short supply – is available to rent rather than purchase. That is the case with some of the apartments at Tour Odéon, which can only be rented and they, too, have set new price records of €1,500/sq m per year (where around €700/sq m is the norm in other new developments in Monaco), so the monthly rental for a 200 sq m apartment would be upwards of €25,000.

Monaco residents are global, welltravelled and possess great wealth, often self-made. As Monte Carlo sees upgrades to its landmark buildings, squares and sporting facilities such as the new yacht club, the age of new residents is falling. These are people who have created wealth early in their careers, not just retiring business people, and they feel that Monaco can offer them not just the tax breaks, but the full package of safety, proximity to some of the most beautiful beaches in the Mediterranean, a social calendar that takes in world-famous film festivals, sailing regattas, tennis tournaments and Formula 1.

Provided you have the means, Monaco is an easy place to live and an easy place to commute to and from. It basks in the reputation of its glamorous past, but offers what the world’s wealthiest want for modern living. It still possesses a certain mystique, but in fact Monaco’s charms are laid bare for all to admire.

Magnificent Monaco

Parading the trappings of the ultimate luxury lifestyle and basking in the sunshine of the French Riviera, it has long attracted the world’s wealthiest individuals.

By Zoe Dare Hall

Although some would dispute the term ‘tax haven’, with no income, capital gains, wealth or property taxes for residents, Monaco is a low tax environment, and many of the world’s richest have sought residency there for that reason.

But times are changing. Monaco, like Switzerland, has signed transparency agreements to end banking secrecy. Gone are the days when you could deposit your worldly wealth in Monaco’s banks and no one would be any the wiser. Now the choice of where to live is becoming far more about a well-balanced lifestyle rather than balancing the books, and Monaco is adapting accordingly, building, remodelling and expanding to become a place that the global super-rich will consider a permanent home.

Monaco will always attract the rich because of its tax haven status, but it is also its appeal as a safe haven that is driving many nationalities to consider moving there, according to Niccolo Marzocco, Commercial Director of the property development company Groupe Marzocco, run by his father Claudio and his family.

Niccolo’s family moved from San Remo to Monaco for security reasons when he was four years old in 1988. His grandfather was already developing property in Monaco and Niccolo’s father felt it was the safest place for his family to live.

Three decades on, Niccolo is witnessing a growing number of wealthy individuals moving to Monaco for similar reasons. “We are seeing people from Dubai and all over Europe looking to become resident in Monaco partly for the sun, sea and lifestyle, but also for the security, says Niccolo. With more police per person in Monaco than any other country there is reason to feel secure. You are never alone here as Monaco is so densely-populated,” he comments.

As more people seek to make this tiny Principality their permanent home, Monaco is starting to build a greater sense of year-round community.

“After the global financial crisis in 2009, people said Monaco would lose its appeal but it appears to have benefitted. It’s a far better place to live now than it was several years ago. Some people left, but far more have arrived. They want to live here full-time so they want bigger apartments, better shops and good schools. The requests for residency have never been higher than in the last 10 to 15 years.”

Monaco’s restaurant scene is also blossoming, with the likes of Nobu, Cipriani, Song Qi and Twiga having opened recently. Niccolo also regularly pops over the Italian and French borders to restaurants in towns such as Bordighera, Menton and Beaulieu.

The other way the Monagasques kick back is on the beach – either Monaco’s Larvotto or the private stretch belonging to the Monte Carlo Beach Club. Or you have the run of the French and Italian Rivieras at your fingertips, with the beautiful beaches in Cap d’Ail and St Jean Cap Ferrat.

Despite the glamour it exudes, one way in which Monaco has historically struggled to live up to international standards is in its property offering.

“Monaco was missing the services you find in high-end properties in other world cities,” says Niccolo, referring to the hotel-style concierge services that have become a staple for luxury developments in New York, London and Dubai.

“There are over 120 nationalities living in Monaco and they typically want something new, but there are very few new apartments in Monaco. Even the newly-renovated apartments are still in old buildings where you have no services, old common areas and old lifts,” he says. “If you want a 400 sq m apartment, you could see everything available in less than a day. Buyers are sometimes disappointed.”

It is unlikely they will feel the same way with Groupe Marzocco’s landmark project, Tour Odéon, which is Monaco’s tallest building at 49 storeys and 170 metres, set in the quiet La Rousse area, next to the Place des Moulins.

Tour Odéon brings a level of service previously unseen in Monaco, with 3,000 sq m of space dedicated to residents’ services, including a spa and concierge office. The building provides its residents with the utmost in luxury, but it is the simplest things that prove most popular, including a chauffeured Mercedes S-Class and Viano at residents’ disposal. “It’s a small but very practical thing, many people prefer not to have to try and find a parking space in Monaco. No one goes far, so the car is usually back within five minutes for someone else to use. We asked ourselves, ‘what would be ideal to have here?’ The little things that make you live better,” says Niccolo.

There is also the building’s penthouse, a five-storey property that spans 3,500 sq m and includes a circular outdoor infinity pool with a water slide. Its price will only be revealed to serious buyers, but Niccolo says it is “well above” the €300m figure that has appeared in the press.

“We could have turned the top floor into two penthouses, but we decided to do something big and crazy and a total one-off,” says Niccolo. “It’s something difficult to describe. You need to see it. The space, light and views are unlike anywhere else. Someone may buy it as a trophy flat, but my feeling is that you only live once, so if you have the means, it is somewhere you should live in and enjoy.”

It’s a mantra that Monaco is taking to heart, with improvements going on all over the place. The famous Place du Casino is part way through a five-year transformation, along with the overhaul of its landmark building, the 150-year-old Hotel de Paris. Foster + Partners have provided a new centrepiece and social hub for the remodelled harbourfront with the new Yacht Club de Monaco.

Among Monaco’s new residential schemes is Groupe Marzocco’s Testimonio II, to include luxury private property, state housing and a new international school for 700 pupils that Niccolo says “will be the best school in the region, with fantastic facilities”. Finally, there is now a new €100m tunnel designed to ease the congestion for the 56,000 people a day who drive into Monaco for work.

It is all helping to make Monaco more desirable as a permanent haven – but a haven in a far wider sense than it has been seen in the past.

Pole Position

After several years of limited supply, Monaco’s new-build offer is expanding and with it, the gulf between resale and new home prices.

By Kate Everett-Allen

For a principality no larger than two square kilometres – smaller than Hyde Park and Kensington Gardens combined – Monaco, home to 12,200 millionaires, punches well above its weight.

Offering privacy and security – in a climate of increased geopolitical tension – as well as a benign tax regime, it comes as no surprise that its population of wealthy people (those with net assets of US$30m+) has increased by 62% in the last decade.

Due to high demand and limited supply, prices have, aside from a marginal dip in 2012, largely moved in one direction since 2010. Average prices have increased by 27.8% in the last five years according to the Monaco Statistics office, but what stands out is the widening gulf between the price of new and resale properties.

Data from 2015 shows the average price of a resale property stood at €3.5m, whilst the average price of the 38 new-build apartments sold in 2015 was closer to €11.9m.

This appetite for new product and modern specifications means buyers – both owner occupiers and investors – are more likely to refurbish an older property compared to say properties just across the border in France and Italy.

Rental demand is also strong. Residency is conferred on those who rent as well as buy in Monaco, provided the tenant occupies an appropriate size property, for example a minimum of a two bedroom property for a family of four. Families will often rent close to the International School of Monaco in La Condamine before deciding where to buy.

Monaco’s constrained supply pipeline improved in 2015 when 195 new apartments housed within three new prime developments (Tour Odéon, Le Meridien and Le Petitie Afrique) came to the market.

The next single largest contribution to housing stock will be the delivery of Testimonio II, which will provide some 150 apartments. It will be built by the Marzocco’s, the developers responsible for Tour Odéon which provided a new high level of finish and amenities unseen in a large scale development in recent years.

Monaco’s buyer profile is shifting. Not only is the age of buyers lower than it was a decade ago, but the nationality of buyers can increasingly be defined according to their purchasing power. Below €10m British, Italians, Swiss and northern European buyers have been active in the last year. Above €10m, Russian buyers, previously absent, are house-hunting once more, joined by Middle Eastern and Chinese buyers.

Sales activity in 2015 was focused at the lower end of the market. Of the 509 resales properties that changed hands in 2015, 423, or 83%, were priced below €5m.

The UK Chancellor’s decision in July 2015 to change the rules that apply to those claiming non-dom status put Monaco back in the spotlight. It is proposed that from 2017 some non-doms living in the UK will find it harder to claim nondom status and benefit from the remittance basis. Agents surmise this, and not the Brexit decision, will in the long-term prove the key determinant of inward capital flows to the principality.

The Purchase Procedure in Monaco

Thinking of buying in Monaco? Our step-by-step guide takes you through some of the key considerations.

Choosing a Notary

Whether you’re a buyer or seller it is recommended to seek a Notary’s opinion or independent legal advice before entering into any form of written agreement. Whilst the buying process is relatively straightforward, the assistance of a lawyer or Notary at the early stages of a deal is invaluable in ensuring a smooth and risk free transaction. There are three notarial offices in Monaco.

The Notary’s role is to ensure the letter of the law is applied and that the interests of both parties, relating to the sale and purchase are protected. The Notary undertakes the relevant searches and highlights important factors such liens, right of ways and planning discrepancies, as appropriate and also ensures the title is passed onto the new owner.

Due to the Notary’s mandate and impartiality, it is not uncommon for one notary to act for both parties. This is not mandatory and either party may select their own representative independently. It is important to note that having two notaries does not increase the cost of the transaction as the Notaries will share the fees among them.

The Offer Letter

(Offre d’Achat)

Having identified the right property, often the buyer will be asked to confirm the intention to purchase in writing. This may be in the form of an offer letter or ‘Offre d’Intention d’Achat’ describing the property, outlining the purchase price, as well as a lock out date by which the purchaser endeavours to move toward exchange.

The preliminary document of offer and its subsequent acceptance is usually signed setting out the terms and conditions of sale. The accepted offer is considered binding and may be prepared by property agents, but is often drafted and/or reviewed by lawyers. It is at this point that the buyer and seller will need to instruct a Notary.

The offer letter is countersigned by the vendor accepting the price and the period of exclusivity the buyer is granted in which to proceed. The countersigned document binds the vendor to the terms stated and also precludes the vendor from entering into any other sale agreement during the period of exclusivity. During this period the parties may meet the Notary, discuss the proposed terms and any conditions of sale which will be summarised and included within a ‘Compromis de Vente’ or a ‘Promesse de Vente’.

Purchase Contract

(Compromis/Promesse de Vente)

With everything agreed, the Notary prepares the purchase contract or ‘Compromis de Vente’. This will provide a completion date, typically in a week to a months’ time, to allow the Notary to complete the file and relevant searches. The property may be subject to pre-emptive rights to purchase by the government, in which case the sale cannot take place earlier than within a months’ time or when said rights are waived. Moreover, the ‘Compromis’ will refer to conditions precedent that, unless satisfied, will allow the buyer to withdraw within a fixed period. The conditions may concern obtaining financing, making physical modifications, or planning matters to name but a few, however, financing and planning permission are unusual conditions precedent in Monaco.

Fulfilling conditions precedent is a requirement to allow the sale to complete. Failure to fulfil all of these will allow the buyer to exit the purchase with no penalties and a full refund. The ‘Compromis de Vente’ is typically accompanied by a 10% deposit entrusted to the Notary and held in Escrow. The parties may decide, however, to skip the ‘Compromis’ or ‘Promesse’ and go directly to completion.

Completion

(Acte de Vente)

Completion of the sale takes place at the Notary’s office with payment of the balance. Notary’s fees and transfer taxes are also all due at this stage and costs are borne by the buyer. Once the ‘Acte de Vente’ is signed, the Notary will transfer the funds that would have been already deposited into their account, and register the new owner at the registry of deeds, together with any mortgage.

Purchase and Ownership Costs

Property registration tax, title registration and notary fees together are 6% if the property is purchased by a person or a Monaco “Société Civile” owned by physical persons. If the property is purchased by other types of companies or by foreign companies, it is 9%. For new construction or new build properties, 20% VAT is due in lieu of registration tax. It is important whennegotiating to buy a new construction that the price is understood to include VAT.

Marginal additional costs may apply according to the number of pages in the ‘Acte de Vente’ and further costs may apply if there is financing involved. Agents fees payable by the seller are customarily 5% (plus 20% VAT) and those payable by the buyer 3% (plus 20% VAT).

Shares transfers of companies owning properties in Monaco are subject to a 4.5% tax. If the company is a Monaco company, payment will be due when the transfer is registered at the tax office. If the company is a foreign company, payment of this tax is guaranteed by the foreign company’s Monaco tax representative.

Anyone considering purchasing a company that owns Monaco property must verify that the company has complied with all regulations regarding the appointment of a tax representative.

Other Considerations

This note is meant to provide a very basic indication of the purchasing process. No liability is assumed as it is strongly recommended that interested parties should seek the appropriate local, independent legal and fiscal advice in order to structure a deal in the most efficient way.

Courtesy: Knight Frank

Donald Manasse Law Offices

Est-Ouest

24 Boulevard Princesse Charlotte

Mc 98000 Monaco

+ 37 7 93 50 29 21

+ 37 7 93 50 82 08

www.manasselaw.com

The Monaco Team

London

EDWARD DE MALLET MORGAN - Head of Monaco Department

+44 20 7861 1553

KATE EVERETT-ALLEN - International Research

+44 20 7167 2497

ASTRID ETCHELLS - International PR

+44 20 7861 1182

Monaco

PVN Real Estate Investments

Le Park Palace, 6 Impasse de la Fontaine

Monte Carlo MC-98000, Monaco

PIETER VAN NAELTWIJCK - Owner & Director

+33 6 07 93 05 36

FRANCOIS DE BRUYNE - France Sales

+33 6 07 93 58 54

NATACHA IVANOVA - Monaco Sales

+33 6 15 61 75 23

Important Notice

© Knight Frank LLP 2016 – This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.