Property Finance - The Centre for Affordable Housing Finance in Africa

This report was prepared by Adelaide Steedley of the Centre for Affordable Housing Finance in Africa. For more information contact Adelaide Steedley at the Centre for Affordable Housing Finance in Africa at 0114479581 or e-mail [email protected].

The Centre for Affordable Housing Finance in Africa (CAHF) was until recently the housing finance division of FinMark Trust, a non-profit trust with an overall purpose of “making financial markets work for the poor”. The CAHF’s vision is an enabled affordable housing finance system in countries throughout Africa, where governments, business, and advocates work together to provide a wide range of housing options accessible to all. CAHF’s mission is to expand Africa’s housing markets for all of its residents through the dissemination of research and market intelligence, supporting cross-sector collaborations and a market-based approach. The overall goal of CAHF’s work is to see an increase of investment in affordable housing and housing finance throughout Africa: more players and better products, with a specific focus on the poor.

New Understanding in Affordable Housing Markets: The Housing Performance Index

Affordable markets: Perception versus Reality

Affordable housing markets, or those areas or properties where property values are under R500 000, are often perceived as weak, stagnant and risky. A very different reality appears, however, when key market indicators of affordable housing markets are isolated and compared to overall markets.

When comparing affordable property markets to the property market overall, evidence indicates that:

- affordable markets are actually growing faster than other housing markets overall;

- many markets that are considered to be affordable by average values are, in fact, not affordable when local incomes are used to measure housing affordability; and

- equity can be used to close the housing gap and double the purchasing power of homeowners in affordable markets.

New Possibilities in Understanding Housing Markets

The Centre for Affordable Housing Finance in Africa (CAHF) recently implemented its CityMark dashboard, merging deeds registry and census data which is hosted in a cutting edge business intelligence platform, and applying its expertise in housing development and finance to explore new ways of understanding affordable housing markets at the local level across major municipalities.

It is consequently now possible to tailor affordable housing solutions within cities using three innovations:

- Housing Performance Index: measuring and comparing a basket of local, key market indicators to the city allows the growth of housing markets to be measured relative to local conditions over time and across all cities.

- Affordability and the housing gap: newly released census data at the local level makes it possible to consider housing affordability relative to local income; to quantify local housing gaps; and to get a better sense of real affordability.

- Equity Leverage: measuring and unlocking the levels of equity in affordable housing markets can help close the affordability gap which, in upper income markets, is the most common way households move up the housing continuum.

Metro Property Markets: Overall Key Findings

The importance of the affordable housing market in South Africa cannot be overstated. This market, indeed, is increasingly being recognised as a critical part of South Africa’s economy. The affordable housing market is commonly understood to comprise residential properties valued at less than R500 000 - such properties are affordable to households having an income of less than R15 000 a month. Some 58% of the six million residentialproperties on the South African Deeds Registry, being 3,4 million properties, are currently valued at less than R500 000.

A person or family’s home is often their most valuable asset, representing their entry into the economic mainstream. In an increasingly urbanised country, cities have a tremendous influence over how opportunities to access housing can be maximised.

Findings

1. Affordable markets drive municipal housing market growth and have grown consistently since 2010. In seven of nine major cities, the affordable areas are growing faster than the municipality itself.

- The fastest growing suburbs are located in many of the lowest cost suburbs within the city while affordable areas overall are growing faster than the municipalities are growing in comparison to the national market.

- Home values and sales prices are appreciating faster while the proportion of affordable homes, and home sales, is expanding more rapidly than the overall property market.

- New registrations and sales of affordable properties are, thus, increasing at a faster rate than across the city’s overall residential property market.

2. In measuring affordability at the local level, many local housing markets are not affordable to the average local income

- New data from the census allows for much more precise determination of affordability levels and housing price gaps: estimating affordable areas by value alone does not consider the ability of local incomes to actually afford those homes.

- Across the nine major municipalities it takes, on average, over three times the average household income for a family to afford an average house. This, however, varies considerably from area to area and from 1,7 times the average income in Tshwane to 2.7 times the average income in Johannesburg and Ekurhuleni.

- The housing affordability gap - the difference between the average sale price and the average affordable mortgage bond of a property - ranges from R286 000 in Tshwane to R454 000 in Ekurhuleni and R648 000 in Johannesburg.

- Understanding affordability and housing gaps at the neighbourhood level can drive housing providers towards implementing both more affordable and more integrated housing solutions.

3. Equity in affordable properties can double purchasing power

- Affordable homes have a higher rate of equity than does the overall market. If leveraged to fill the housing gap equity can, on average, double the purchasing power of lower income households.

- Policies that encourage a better connection between homeowner equity and sales prices can not only drive demand for gap housing but also entice more supply.

- Expanding the housing continuum through the provision of better gap housing will potentially double the housing bond market.

It is proposed, therefore, presently to focus on the Housing Performance Index, some background, key findings and implications and application in the field.

The Housing Performance Index

An index is useful because it not only efficiently conveys the market strengths of an area but also compares larger and smaller markets more effectively and more appropriately within its existing context. The question therefore arises as to how affordable markets are performing when compared to the municipality overall.

Definition and methodology

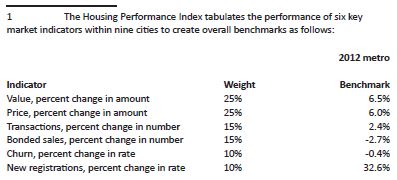

The Housing Performance Index1 (HPI) assists in providing an understanding of local housing market performance by tracking the six key indicators which most effectively convey the fundamental components of real estate markets. The results for affordable areas are compared to the results for the entire municipal property market to determine areas of growth or strength.

The HPI, thus, provides a sense of how local property markets are performing when compared to the city as a whole.

The following profiles are used in this exercise:

“Growing” suburbs are areas that exceed the city’s rate of change in any four of the six key market indicators.

“Stable” areas meet or beat the city in at least three of the key market indicators,

“Slow” areas are growing at rates less than the city in two (or fewer) of the six key market indicators.

Some of the uses of the HPI would include:

- Appropriately siting different development options. Whether seeking the best location for particular development strategies or zones or considering options for a given development site, the HPI begins to inform the appropriate location and scale of development options; how best to promote opportunities for investment; and improves the likelihood of market success and sustainability over time.

- Improving understanding of market opportunities. The market performance of each neighborhood can assist policymakers and investors (developers, lenders and other private sector partners) to understand patterns across the municipality; to learn what might influence the growth or stability of neighborhoods; and to begin to devise intervention strategies that build on the unique strengths of local areas.

- Measuring impact. The index’s behaviour over time can provide quick insights into the impact of past development interventions and initiatives and can assist in answering such relevant questions as:

- Did the growth of the area continue or stabilise after the mall or the transit line was upgraded?

- Did the policy achieve its intended outcome and, if so, how did it do so?

Land developers, investors or municipalities may, for example, be considering land acquisition or disposition strategies involving several large sites or a portfolio of sites.

Understanding the growth profile of local areas can help inform:

- which sites should be retained and developed directly and which should be placed out to tender;

- what type of development is best suited for each site; and, over time

- assess the impact of these strategies.

Just as larger scale dense projects might be more appropriately situated in rapidly growing areas, smaller scale approaches might be more successful in stable or slow growth neighbourhoods.

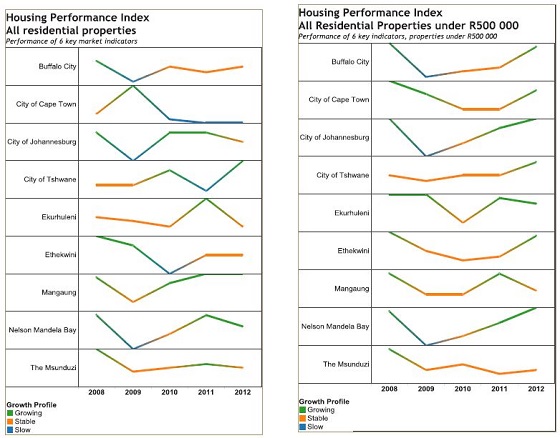

Results show a wide range of growth, stability and sluggishness

While the housing markets in most cities dropped considerably during the 2008 economic downturn it was found that some markets recovered more quickly while others still continue to stabilise. Empirical evidence indicates that in seven out of the nine metros affordable properties are, in fact, growing faster than the cities in which they are located. In the Tshwane metro, however, while the affordable market grew considerably, it did not outpace the growth of the city overall.

The findings again confirm both the strength and importance of the affordable markets to government, local authorities and, also, to property practitioners seeking to establish a footprint in those areas. Ongoing exponential growth in these markets, and the accompanying opportunities which this scenario no doubt presents to property practitioners, is likely in both the short- and medium terms.

It seems that markets which fluctuate greatly over time will probably be more susceptible to change in the future whereas stable areas generally easier to forecast. This factor is important when seeking to project different sales or rental scenarios and when strategising future priority areas.

Full reports pertaining to all of the nine cities investigated, as well as a dynamic dashboard of the housing performance index at the main-place level, may be accessed on the Centre for Affordable Housing Finance in Africa website at www.housingfinanceafrica.org/citymark.

The two charts below track the HPI of the residential property markets in South Africa’s major municipalities, as well as in the affordable property sector. In 2012, the growth of affordable markets in seven municipalities outpaced the wider property residential property markets in those cities. Tshwane experienced great growth as did its affordable properties, although not as great as the metro.

This report was prepared by Adelaide Steedley of the Centre for Affordable Housing Finance in Africa. For more information contact Adelaide Steedley at the Centre for Affordable Housing Finance in Africa at 011 447 9581 or e-mail [email protected]

Courtesy: The Agent - Estate Agency Affairs Board