International Property - Global House Price Index (Residential Research)

SLOWDOWN IN GLOBAL HOUSE PRICES CONTINUES

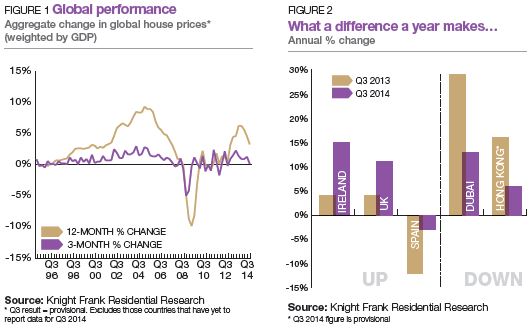

With price growth in Dubai and much of Asia slowing, the Knight Frank Global House Price Index has lost its main engines of growth resulting in a rise of just 0.1% in the third quarter of 2014. Kate Everett-Allen looks at the reasons behind the index’s weak performance.

KATE EVERETT-ALLEN - International Residential Research

Results for Q3 2014

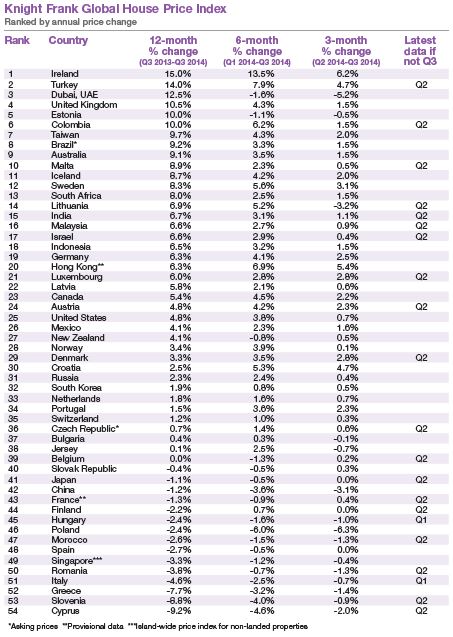

- The Knight Frank Global House Price Index increased by 3.3% in the 12 months to September 2014

- Ireland tops the annual rankings with prices rising 15% on average year-on-year

- Dubai recorded its first quarterly decline in four years, with prices falling 5.2% between June and September

- In China, 58 of the 70 cities tracked recorded a decline in house prices over the 12-month period to September

- No country has recorded an annual fall in house prices in excess of 10% for three consecutive quarters

For the first time in two years the Global House Price Index came close to falling into negative territory. Muted growth in the third quarter comes on the back of jitters over the global economy, a lingering malaise in Europe and, in the US, a slower-thanexpected housing recovery.

Ireland now tops our rankings, having languished at the foot of the table for most of 2009 to 2012. Prices increased by 15% in the year to September but remain 39% below their pre-crisis peak in 2007.

Ireland isn’t the only country to see a remarkable turnaround in fortunes over the last 12 months (figure 2). Spain and the UK have also seen an upturn, albeit in Spain’s case this translates into a slower rate of decline as opposed to positive price growth. Hong Kong and Dubai, by comparison, have seen price growth slow.

Dubai mainstream residential prices fell by 5.2% in the three months to September – the emirate’s first quarterly decline in prices in the last four years. The current mismatch between demand and supply is behind the fall. Residential sales have fallen sharply in recent months and there is a steady stream of new schemes reaching completion, which in turn is exerting downward pressure on prices.

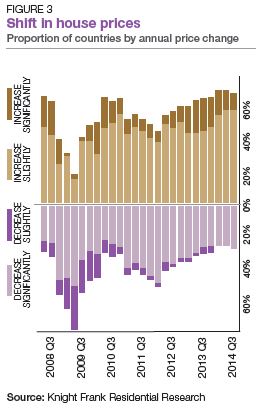

Fewer countries are reaching the heights of double-digit price growth but it’s not all bad news. No country has recorded an annual fall in house prices in excess of 10% for three consecutive quarters suggesting a slight convergence in the performance of the 54 housing markets tracked (figure 3).

China’s slowdown continued with 58 of the 70 cities tracked by the National Bureau of Statistics recording price falls in the year to September; two cities saw prices stay the same and ten recorded price increases. The city of Xiamen saw the strongest annual rise of 4.9%.

In the US, the price of a single-family home increased by 4.8%, down on last quarter’s figure of 6.2%. Miami is the key city bucking the national trend, with prices rising by 10.3% year-on-year.

Analysis by world region shows the Middle East recorded the strongest price growth (9.5%) in the year to September. Quarterly analysis shows all the world regions to be borderline anaemic with South America – the top performer recording 1.6% growth. This was due predominantly to Brazil and Colombia’s steady performance over the three-month period.

DATA DIGEST

The Knight Frank Global House Price Index established in 2006 is the allows investors and developers to monitor and compare the performance of mainstream residential markets across the world. The index is compiled on a quarterly basis using official government statistics or central bank data where available. The index’s overall performance is weighted by GDP and the latest quarter’s data is provisional pending the release of all countries’ results.

CONTACT FOR MORE INFORMATION

RESIDENTIAL RESEARCH

Liam Bailey - Global Head of Research

Tel: +44 20 7861 5133

Email: [email protected]

Kate Everett-Allen - International Residential Research

Tel: +44 20 7861 1513

Email: [email protected]

PRESS OFFICE

Astrid Etchells

Tel: +44 20 7861 1182

Email: [email protected]

Knight Frank LLP 2014 - This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.