Residential Research- Taxing High-Value UK Homes

Key facts, June 2014

- A proposed Mansion Tax, an annual tax on £2m+ properties, was first announced in late 2009

- Revised proposals from the Labour Party this week point to the introduction of indexation to raise the £2m+ threshold over time, to avoid future fiscal drag

- Fiscal drag, through house price growth (especially in London) since 2009, has already led to a doubling in the number of properties defined as “mansions” compared to initial estimates

- If the original £2m+ threshold, from 2009, had increased in line with house price inflation in the areas where most expensive properties are located, it would now stand at £3.2m

- The lack of indexation since the first proposal was made means that properties valued as low as £1.2m in 2009 have now been brought within the ambit of the proposed tax

Liam Bailey - Global Head of Research at Knight Frank

HOW THE NUMBER OF UK “MANSIONS” DOUBLED IN FIVE YEARS

With new proposals for a Mansion Tax being put forward on an almost monthly basis, we revisit the thorny question of how to actually define a “mansion”.

The idea of introducing a new annual tax on high-value property was first put forward in September 2009 by the Liberal Democrats. The initial proposal was for a 0.5% annual levy on the portion of property value over a threshold of £1m.

In November 2009 this initial proposal was amended, so that a 1% levy would apply to the portion of a property’s value over £2m. In February 2012 the Labour Party announced its support for an annual 1% levy on properties worth £2m and above.

With the approach of the 2015 general election both parties have begun to firm up their proposals on the tax.

Earlier this year the Liberal Democrats appeared to shift their thinking towards the creation of additional bands of council tax for high-value properties. The precise details are as yet unknown, but they would appear to remain focussed on properties valued at more than £2m.

This week Labour revealed its latest ideas. Rather than taxing properties with an annual levy based on 1% of the value above £2m, the new proposal is to charge a fixed annual rate based on a value band structure, with the lowest charge for properties valued between £2m-£5m rising in steps to the highest charge for those valued at over £20m.

The additional significant change announced by Ed Balls, the shadow chancellor, in his unveiling of the revised policy, is that these value bands will be indexed in line with average house price growth. This means the starting threshold of £2m will rise over time and, it is hoped, will remove the risk of fiscal drag.

Fiscal drag in action

In our September 2013 report on the original Mansion Tax proposals we noted that the official government estimate for the number of £2m+ properties in the UK in 2009 was 55,000.

Since this original estimate the UK has seen a degree of house price growth, while in London, where nearly 70% of £2m+ properties are located, price growth has been very strong. This means that many properties which were not thought to be mansions in 2009, have effectively been re-designated as such.

This shift in value between 2009 and 2014 is important because it points to a complexity in indexing price growth. Ed Balls, in outlining Labour’s new plans, suggested that future indexation would be in line with national price growth. This would still risk dragging lots of additional properties in high growth areas into the remit of the tax simply because their local market had outperformed the national average.

In fact this process has already taken place.

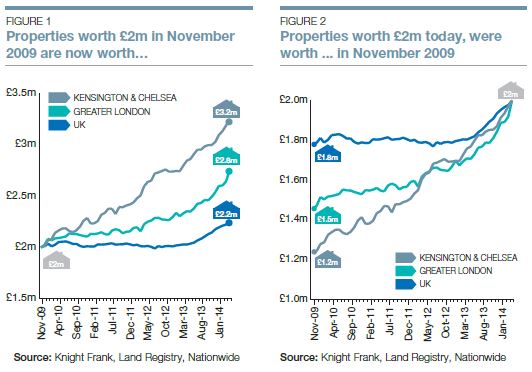

In figure 1 we confirm that in order to avoid fiscal drag, and to tax a constant number of high-value properties, the original threshold of £2m set in November 2009 would need to be increased to £2.2m to keep pace with UK house price growth in the intervening period.

However, even this revised level would be insufficient for properties in London, where much stronger recent price growth means a new threshold of £2.8m would be needed to avoid the expansion of the numbers of properties covered by the tax, compared to the position in 2009.

If we focus on the markets where the biggest concentrations of high-value properties are located, say Kensington & Chelsea, here the new threshold would need to be still higher, at £3.2m, to maintain parity with 2009.

The impact of this differential in price growth is shown more starkly in figure 2. The lack of indexation of the £2m threshold, since late 2009, means that UK properties worth £1.8m at that point have now effectively been designated as mansions. In Greater London and central London all those properties valued at £1.5m and £1.2m respectively in 2009 have now become mansions.

The distribution of property values is such that the movement of house prices over recent years has effectively doubled the number of properties which will be subject to a Mansion Tax, if it comes into effect, compared to the initial estimates produced in 2009. This may well be the first case of fiscal drag before the introduction of a new tax.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Liam Bailey, Global Head of Research

+44 20 7861 5133

PRESS OFFICE

John Williams, Head of PR

+44 20 7861 1738

© Knight Frank LLP 2014 - This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.