International Property - Londons Housing Supply / Residential Development 2014

“The average annual supply of new homes in London since 1980 has been around 16,000 a year. The city needs more than 52,000 homes a year. Activity is rising strongly, but there will still be a shortfall in the years to come.” GRÁINNE GILMORE Head of UK Residential Research.

Market in context

A brighter economic outlook has had a notable impact on the housing market across the country over the last year. With wages beginning to rise in real terms for the first time since 2008, consumer confidence about making large-scale financial decisions such as buying a home or moving to a new property is growing. Add to this the government stimulus to the market, via Funding for Lending and Help to Buy, and it is clear why there has been a strengthening of residential values across the country.

London has been leading from the front in terms of property price growth. In the years immediately following the financial crisis, the prime central London market recovered much more quickly than other markets, showing the strongest price growth of anywhere in the UK between 2009 and 2013. The price growth has taken some time to filter out past the prime central locations – but this ripple effect is now very clear. In fact, price growth in outer London is now outstripping that in prime central London.

Price growth is underpinned by the fundamental imbalance between the supply and demand of homes in the capital. Not only is London’s population soaring, but its economy has grown more quickly than the other UK regions. This economic activity has led to job creation, attracting more workers to London from the UK and from across the globe.

Despite the overwhelming demand for homes, construction of new residential property has failed to keep pace in recent years, further adding to the historical structural undersupply of new homes and creating a “snowball” effect on the supply problem. The pressure in the market is currently being further exacerbated by “stickiness”, with buyers holding onto London property rather than trading up or down, depleting the stocks of available property for sale.

GROWING LONDON

London’s population has risen by around one million over the last 10 years, the fastest rate of growth in the city’s history, according to the Mayor. This growth is set to continue, with new official forecasts showing that London’s population will hit 9.4 million in 2022. This is the equivalent of adding another Birmingham to London’s population. By 2029, the population is forecast to rise to more than 10 million. London’s relatively larger share of younger people is leading to higher birth rates within the city, statisticians say, which is contributing to a higher level of population growth than other areas in the UK. Inward migration is also playing a part.

Employment is also set to grow, with the Greater London Authority forecasting the creation of another 850,000 jobs in London over the next two decades. This will take the total number of jobs to 5.75 million by 2036 equating to around 35,000 additional jobs being created every year and enhancing London’s role in the UK economy. The city already accounts for more than a fifth of the country’s total GDP output. The growth in jobs is expected to be largely concentrated in central, near east and near west London, according to the Mayor’s London plan.

“Through decades of boom and bust, across economic cycles and under every shade of government it was the same story. We just did not build enough homes.” Boris Johnson, Mayor of London

A QUESRTION OF PRICING

Prime central London property prices are rising at an annual rate of around 7.8%. Cumulatively, prices have grown by 70% since the trough after the financial crisis. This trend, coupled with re-generation and re-development in specific areas, has boosted new-build prices across central postcodes, with some of the very prime developments breaking new records for prices per square foot.

Price growth is now rippling out across London, with prices in some prime outer locations and outer London boroughs, now outperforming prime central London prices on an annual basis.

Despite the recent price growth in these areas, the cumulative rise in values has not matched that in prime central London, meaning pricing is starting from a lower base. Across London, cumulative price growth has averaged around 47% since the market trough, with large local variations. For new developments, location, as well as layout and specification, is key to pricing.

There is demand for housing at every point on the pricing scale in London; the type, tenure mix and location of property being developed must take this into account.

Demand for London property is likely to remain high in comparison to the rest of the country, with London’s population growth set to far outstrip the English average over the coming decades. Eight of the top ten local authorities measured by the most rapid forecast growth in population are in London, with Tower Hamlets leading the way. The population in this area of London is set grow by 22% by 2022, according to most recent population projections from the Office for National Statistics.

Construction activity has picked up markedly over the last year in London, with the rise in planning applications seen in 2011 now filtering through to new starts, which were 42% higher in 2013 than in 2012, weighted towards private housing starts in the outer boroughs. However, looking further down the planning pipeline the picture becomes less clear, with a 34% drop in planning applications submitted in 2013 compared to the previous year, according to EGi.

Measuring supply

We have examined all the schemes currently in the supply pipeline, making assessments about how many units will be delivered and over what timeframe. We have measured schemes which have been granted outlined or detailed planning permission, or which are at appeal stage. The results are averaged over ten years to give an overview of the medium-term picture.

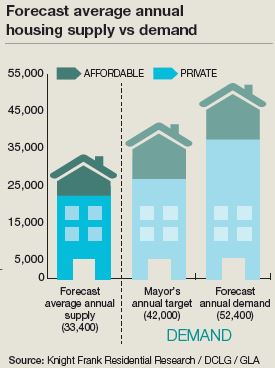

Overall, we can see that around 33,400 units will be delivered on average each year. This is up from around 28,000 as shown in last year’s London Residential Development Report, a reflection of the increased activity in the market, not least because of more readily available funding for residential schemes, especially in the outer boroughs of London.

Within this total, the figures suggest an average of 22,400 private units each year and a further 11,000 affordable units. In prime central London, which we have calculated using the boroughs of Kensington & Chelsea, City of Westminster, City of London and Camden, it is expected that 2,640 units will be delivered on average each year over the next decade, up from last year’s average of 1,940. However this still falls well short of annual household growth of 4,050 in the central boroughs.

Looking in more detail at the planning pipeline year by year, it appears able to deliver up to more than 40,000 units per annum over the next few years. However a key constraint remains the actual capacity of the sector to deliver this increase in activity. The evidence from data on housing starts in London is that activity is rising rapidly (to its highest level in a decade) but even so, the number of residential units on which work was started last year was around 28,800, some way below the housing need. Since 1980, the annual average supply in London has been around 16,000, units a year so this marks a significant rise in capacity.

In terms of where supply is coming through, figure 7 shows that future development is concentrated towards the east of London. This reflects where large tracts of development land are available in fairly central locations. The importance of infrastructure is key. The improvements already seen in the transport links in this area of London, including incorporating the East London Line into the London Orbital overground trainline which runs around the capital have had beneficial results for homeowners. The arrival of Crossrail will further open up the possibilities in these areas, improving the ease of commuting and travelling across London, and dramatically cutting the time taken to do so. Given the size of the schemes in these areas, some of them will take years to build out, running beyond our 10-year time forecast horizon.

The local authorities in Tower Hamlets, Newham, and Greenwich are likely to be acutely aware of the rising demand for housing in their areas, but also alive to the reality that in London, home buyers and renters move easily across borough boundaries. Attracting new residents to their areas can only help improve the economy of the locality as more service businesses flourish.=

Measuring demand

Boris Johnson, the Mayor of London, has pledged to increase development volumes to 42,000 a year – and is making his determination to boost London’s housing supply clear by lobbying the Government for a share of stamp duty receipts to be routed straight to the Mayor’s office to help fund infrastructure. New roads and rail lines can be a key element of making new housing viable and can often prove a sticking point in the development process.

Richard Blakeway, the Deputy Mayor on housing, said: “If you build a certain amount of homes you could hypothecate the stamp duty take on that. This would allow you to provide up front finance to service the site and then repay the money through stamp duty receipts in the future… The idea that stamp duty can be reinvested to support growth and infrastructure is something the Mayor is strongly advocating.”

However the Treasury chooses to share the stamp duty spoils, the Mayor’s target of 42,000 a year, every year, still seems high when looking at the schemes currently underway. This target is lower than Knight Frank’s demand forecasts. We are using the latest official household growth projections as a proxy for demand. These figures from the ONS show that the number of households in the capital will grow by an average of 52,400 a year until 2022. Within this, we estimate that demand for private housing will be 36,700 a year.

The historical growth in households has been lower than previous household projections have suggested, but this is largely because the growth of households is constrained by what is actually being built. A household can only be created if there is space within bricks and mortar for it to do so. As can be seen in figure 1, there remains a mismatch between supply and demand. Indeed this has prompted several large housebuilders to call for the Mayor to push local authorities to make more of their land available for development and build higher density schemes.

The current data suggests a continued shortfall of homes across London over the next decade.

Courtesy: Knight Frank

RESIDENTIAL RESEARCH

Gráinne Gilmore, Head of UK Residential Research

+44 20 7861 5102

Liam Bailey, Global Head of Research

+44 20 7861 5133

RESIDENTIAL DEVELOPMENT

Justin Gaze, Joint Head of Residential Development

+44 20 7861 5407

Ian Marris, Joint Head of Residential Development

+44 20 7861 5404

Rupert Dawes, Head of New Home Sales

+44 20 7861 5445

Knight Frank Residential Research provides strategic advice, consultancy services and forecasting to a wide range of clients worldwide including developers, investors, funding organisations, corporate institutions and the public sector. All our clients recognise the need for expert independent advice customised to their specific needs.

© Knight Frank LLP 2014

This report is published for general information only and not to be relied upon in any way. Although high standards have been used in the preparation of the information, analysis, views and projections presented in this report, no responsibility or liability whatsoever can be accepted by Knight Frank LLP for any loss or damage resultant from any use of, reliance on or reference to the contents of this document. As a general report, this material does not necessarily represent the view of Knight Frank LLP in relation to particular properties or projects. Reproduction of this report in whole or in part is not allowed without prior written approval of Knight Frank LLP to the form and content within which it appears. Knight Frank LLP is a limited liability partnership registered in England with registered number OC305934. Our registered office is 55 Baker Street, London, W1U 8AN, where you may look at a list of members’ names.