International Property - Hong Kong tops 2012 mainstream global house price table

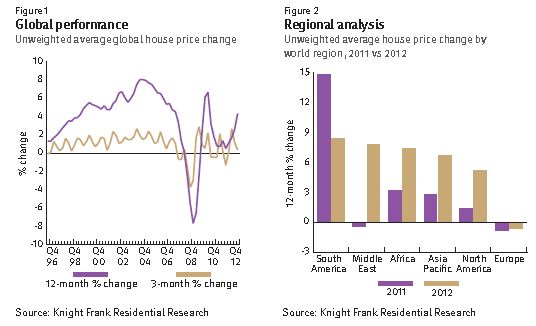

House prices around the world rose by an average of 4.3% in 2012 according to Knight Frank’s Global House Price Index. As Kate Everett- Allen explains, stronger conditions across all other world regions are offset by continuing challenges in the main European markets

Results for Q4 2012

- The Knight Frank Global House Price Index rose by 0.3% in the final quarter of 2012 and by 4.3% in the last 12 months

- Hong Kong recorded the largest rise, here mainstream prices rose by 23.6% in 2012

- Greece recorded the largest fall in mainstream prices for the second consecutive quarter, declining by 13.2% on average in 2012

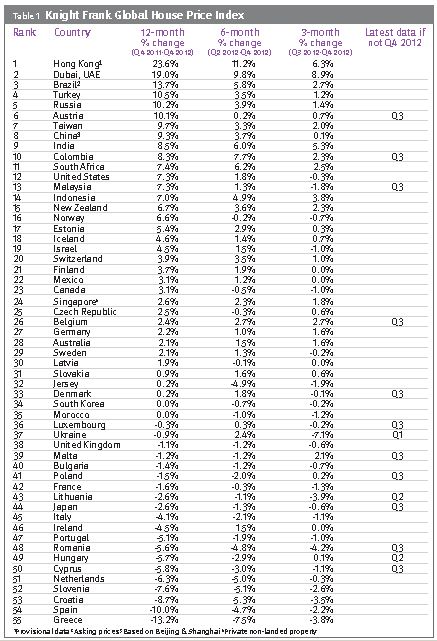

- Analysis by world region shows house prices in South America experienced the strongest growth in 2012, an increase of 8.4% on average

- Mainstream property prices in Asia Pacific rose faster in 2012 than in 2011, increasing by 6.7% on average compared to 2.8% a year earlier

The 2012 results suggest the rehabilitation of the world’s housing markets – following the global financial crisis – is still a ‘work in progress’. The overall picture is an improving one, albeit marginally so.

Of the 55 housing markets we track 20 saw prices fall in 2012, down from 25 in 2011. What is more telling perhaps is the fact that 19 of the 20 countries which experienced price falls in 2012 were located in Europe.

Hong Kong leads the pack, here mainstream property prices rose on average by 23.6% in 2012. With supply lagging, demand from mainland Chinese investors keen to get their slice of Hong Kong’s real estate prices, has surged.

However, if the Hong Kong Government’s latest efforts to increase stamp duty is a measure of their determination to cool price growth we can expect a return to more muted growth in 2013. Properties worth below HK$2 million now incur a stamp duty of 1.5%, while the rate for properties worth above HK$2 million has been doubled, to up to 8.5% of the property’s value.

Dubai, in second place in 2012’s rankings, experienced price growth of 19% in 2012. For several years the ‘yo-yo’ of the rankings, the Dubai market is finding its feet. Stalled developments are being resurrected, sales volumes are rising and the level of market transparency is improving.

If the Eurozone, having entered its second recession in four years, is the cloud on the global housing market horizon, the US offers a chink of light. In 2012 US property prices grew by 7.3%, the largest annual rise since 2006. In 2012, 19 of the 20 US cities in the S&P/Case- Shiller Index posted annual price gains but tight lending still has the capacity to curb the speed and strength of the recovery in 2013.

Turning to Europe, Turkey, Russia and Austria bucked the region’s wider trend of negative price growth, recording growth of 10.5%, 10.2% and 10.1% respectively in 2012.

However, Greece, Spain and perhaps more surprisingly the Netherlands languished in the bottom five rankings for the second consecutive quarter. Ireland, a long-term resident at the foot of the table looks to have broken free, recording a fall of 4.5% in 2012, compared to a 16.7% decline a year earlier.

2013 looks unlikely to deviate significantly from 2012’s script. The performance of the world’s mainstream housing markets will depend on finding some economic stimulus, relaxing lending criteria and instilling buyer confidence. Europe presents the main downside risk acting as a brake on global growth.

Courtesy: Knight Frank

For further information, please contact:

Bronya Heaver [email protected] +44 (0)20 7861 1412