Property Trends - ABSA House Price Index

According to the latest Absa House Price Index, nominal year-on-year growth of 13,6% was recorded in June 2006 compared with a growth rate of 14,3% in May (also see sectionbelow on changes to the Absa House Price Index). This was the lowest year-on-year growth since January 2002 when it was also 13,6% and brought the average price of a house in the middle segment of the market (see explanatory notes) to about R798 000 in June. The average nominal year-on-year growth in house prices came to 15,3% in the first six months of 2006.

In real terms, year-on-year growth of 10% was recorded in May compared with a growth rate of 11,4% in April, based on the headline consumer price index. This was the lowest real year-on-year growth since March 2003 when it was 9,2%. The average real year-on-year growth in house prices came to 11,6% in the first five months of 2006.

On a month-on-month basis, nominal growth in house prices was down to 0,6% in June compared with a growth rate of 0,7% in May. Real month-on-month growth of only 0,1% was recorded in May this year.

Based on an average mortgage interest rate of 10,87% in June this year, the monthly mortgage repayment on a 100% mortgage on a house of R797 930 in June was R8 166, calculated over a period of 20 years. This was 16,3% higher compared with May 2005. The gross monthly household income required to qualify for the abovementioned mortgage of which the monthly repayment does not exceed 30% of income, was R27 219 in June 2006.

CPIX inflation increased to 4,1% in May on the back of a weaker rand exchange rate and an international oil price which is still around the level of $70/barrel. CPIX inflation is projected to rise further to a level of about 6% by year-end. The deficit on the current account of the balance of payments was a massive 6,4% of GDP in the first quarter of 2006, which contributed to the rand depreciating significantly against the major international currencies. Year-on-year private sector credit extension remained high at 22,7% in May, with mortgage advances growth still at a level of 30% compared with a year ago.

Against this background, interest rates are forecast to rise further by 50 basis points at each of the remaining MPC meetings in August, October and December this year. This will bring the prime interest rate and variable mortgage rates to a level of 12,5% at year end. As a result of these expectations, house prices are projected to increase by about 12% year-on-year in nominal terms this year.

Changes to the Absa House Price Index

In 2004, South African residential property prices increased by a massive 32,2% in nominal terms, while another 22,9% increase was recorded in 2005. In the first six months of 2006, nominal house price growth came to 15,3% year-on-year.

As a result of the continued increase in house prices, it was decided to adjust the upper cut-off price for residential properties in the middle segment of the market (houses of between 80m and 400m, priced up to R2,6 million in 2006 previously R2,2 million) for the purpose of calculating the Absa House Price Index. This decision was based on the fact that, by keeping the upper cut-off price for the middle segment constant at R2,2 million for too long, an increasing number of properties at the upper end of this market segment are migrating to the luxury category, which may cause the average price of houses in the luxury category to decline.

In its analysis of house prices in South Africa, Absa differentiates between three broad categories of housing. These categories are the affordable housing market (houses of between 40m and 79m, priced at up to R226 000 in 2006 previously R193 000), the abovementioned middle segment of the market and the luxury market (no size limits, but priced at above R2,6 million in 2006 previously R2,2 million). The monthly Absa House Price Index analysis is based on the abovementioned so-called middle segment of the market, in respect of which loan applications were approved by Absa.

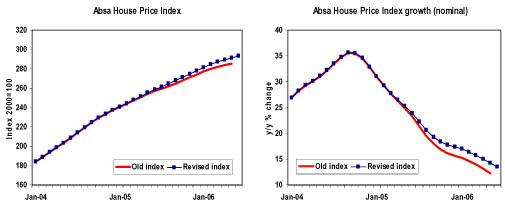

Against this background, the upper cut-off price for properties in the middle segment of the market was revised from R2,2 million for 2004 to R2,4 million for 2005, while it was increased to R2,6 million for 2006. These adjustments to the upper cut-off price in both 2005 and 2006 resulted in higher index values and year-on-year growth rates as from 2005 (see graphs below), as more properties of a higher value are now included in the middle market sample. However, in order to prevent a sharp decrease in the sample size of luxury properties, the upper cut-off price of this category was increased from R8,2 million for 2004 to R8,9 million for 2005, and to R9,5 million for 2006.

Courtesy Jacques du Toit Senior Economist ABSA Bank