SA Property Tax - Transfer Duty, Value Added Tax (VAT), Donations Tax, Withholding Tax and Income Tax

PROPERTY AND TAX

Most property transactions in South Africa are affected by the legislation in terms of which taxes and duties are levied. This article provides a summary on some of these taxes.

Transfer Duty

Transfer duty is, generally speaking, payable when immovable property is acquired. It is payable by the purchaser and is calculated as a percentage of the purchase price. If SARS is of the opinion that the purchase price is less than the fair value of the property, then SARS will calculate the transfer duty based on the fair value.

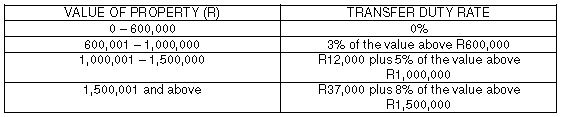

The current transfer duty rates were announced in the Budget on 23 February 2011. They are applicable to both individuals and legal persons (companies, close corporations and trusts) in respect of properties acquired under sale agreements concluded on or after 23 February 2011. The rates are as follows:

Transfer duty is payable within six months from the date of acquisition, which is usually the date the sale agreement is signed, failing which SARS will charge penalty interest.

A purchaser does not pay transfer duty in transactions where VAT is payable. In such instances, the purchaser will pay the purchase price and VAT to the seller who is then responsible for paying the VAT to SARS.

Value Added Tax (VAT)

VAT is payable on the supply by a VAT vendor of goods supplied in the course and furtherance of any enterprise carried on by such vendor. In relation to a property transaction, this means that if the seller is a VAT vendor and the sale of the property is in the course and furtherance of the seller’s enterprise then VAT will be payable on the purchase price.

Ordinarily such VAT will be calculated at the rate of 14%. However, if the property is sold as a going concern, VAT will be calculated at the rate of 0%.

In order for the sale of a property to be “zero-rated” the following main requirements must be met:

- The seller and purchaser must be VAT vendors.

- The seller and purchaser must agree in writing that the property is sold as a going concern and that the purchase price is inclusive of VAT at the rate of 0%.

- The property must constitute an income earning activity.

- The sale of the property must include all the assets required for carrying on the income earning activity.

Donations Tax

Donations tax is payable on the value of property disposed of by a resident by means of a donation. Donations tax is levied at 20% on the value of the property donated and is payable by the donor. There are certain exemptions from donations tax. It is important to bear in mind that if SARS is of the opinion that a property has been disposed of for a consideration which is not adequate, then the property will be treated as having been disposed of by donation and donations tax will be payable.

Withholding Tax

Non-residents are liable to pay capital gains tax when they dispose of immovable property situated in South Africa. SARS found this taxation of non-residents difficult to enforce and therefore introduced a “withholding tax” provision in the Income Tax Act.

In terms of the provision, when a purchaser buys immovable property from a non-resident and the purchase price is over R2 million, the purchaser must withhold a certain percentage from the amount due to the seller and pay this to SARS. In most instances, this payment will be done on the purchaser’s behalf by the conveyancers attending to the transfer. The amount withheld from the seller is seen as an advance on his tax liability for that tax year.

The current withholding tax rates are as follows: if the seller is a natural person, the purchaser must withhold 5% of the purchase price, if the seller is a company, 7,5% and if the seller is a trust, 10%.

Income Tax Act – transfer of residence grace period

The grace period which was introduced in terms of the Income Tax Act in 2009, which allows for a primary residence owned by a company, close corporation or trust, to be transferred to the relevant individuals of such entity without incurring CGT or transfer duty, has been amended. The initial grace period now only applies in respect of a property which has been acquired by an individual from the relevant entity by no later than 30 September 2010.

In order to take advantage of the new grace period, the following requirements must be met:

- The residence must be disposed of to a person who is a “connected person”, as defined in the Act, in relation to the entity.

- The person must have ordinarily resided in the residence from at least 11 February 2009 to the date of disposal and the residence must have been used mainly for domestic purposes.

- The disposal must take place on or before 31 December 2012.

- Within six months from the date of disposal the entity must take steps to liquidate, wind up or deregister.

Distributed on behalf of Garlicke & Bousfield Inc.

For more information contact:

Victoria Hodgon, a Director in the conveyancing department at Garlicke & Bousfield Inc.

Tel: 031 570 5328 or

Email: [email protected]

This article is an original work of copyright and any reproduction of the article in any manner or form should be done so with the consent of the author and with the author acknowledged accordingly.

Distributed by Shirley Williams Communications Telephone 083 303 1663.