Inflation - The retired investor’s enemy no.1

Planning for the future is inherently difficult, but one of the biggest problems facing retirees is the level of inflation. Marriott Asset Management expects inflation to resurface and explains the investment implications.

We consider inflation to be the most important economic variable for retirees as it has a profound impact on the lifestyle of income-dependent investors. In addition, inflation affects the pricing and yields of assets. As a result, inflationary expectations form an integral part of Marriott’s income-focused investment style.

There are two principles of income-focused investing: firstly, we select securities that produce reliable – ideally growing – income streams; and secondly, we attempt to purchase these income streams at appropriate prices. We would consider an investment to be priced appropriately when the combination of its income yield and income growth prospects are likely to exceed the eroding effect of long-term inflation by an acceptable level. In other words an investment should be priced to produce a total return in excess of inflation. Reasonable inflationary expectations are therefore fundamental in establishing an appropriate price to pay for an income stream.

A minimum return that an investor should accept from an investment is inflation+3%, as one can buy government-backed inflation-linked bonds guaranteeing the investor a real return of 3%. For both property and equity, an investor would require a higher return, given the greater level of risk associated with those asset classes relative to bonds.

We’ve had it good with low inflation

2010 proved to be a year that erased the losses investors experienced as a result of the worldwide credit crisis and subsequent global recession. A significant contributing factor to the JSE recovery and the good returns of property (+29.6%) and bonds (+15%) was the high levels of foreign inflows into South African capital markets which increased the demand for listed securities beyond local demand. A consequence of R96.6 billion of foreign inflows has been a strong local currency which, in turn, resulted in lower inflation and support for all SA asset classes.

However, current low levels of inflation are unsustainable and should not form the basis of long-term domestic inflationary expectations. Factors which will contribute to rising inflation in the years ahead include structural inefficiencies within the South African economy and rapidly rising commodity prices.

But low inflation can’t continue

Structural inefficiencies in South Africa remain high. On the labour front, unit labour costs (effectively wages) are rising at a rate of 11%, well above inflation levels. In addition, labour productivity gains lag most other emerging markets. SA’s labour productivity gains have been paltry, scoring the second lowest improvement out of 18 countries from 1990 to 2008. Even Nigeria saw a 50% rise in productivity compared to South Africa’s 20%. During the same period, the real cost of labour in South Africa rose by 180%.

Another structural inefficiency within the SA economy relates to the cost of electricity and other administered prices. During 2010 electricity prices and water prices increased by 18% and 9% respectively. Despite these prices forming a relatively small component of the CPI basket, these increases influence the production costs of all goods and services in SA and therefore have a broad based inflationary impact.

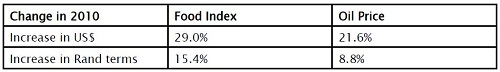

Commodity prices also increased substantially during 2010. For the year food prices (US$) increased by 33%, the oil price (US$) increased by 22%, the cotton price (US$) increased by 100% and the metals index (US$) increased by 19%. Unsurprisingly we are witnessing the re-emergence of inflation globally with a number of countries –developed and emerging – currently experiencing consumer price increases above their inflation targets.

Two countries, however, stand out in contrast: South Africa and Australia. Significantly, both countries experienced substantial currency appreciation during 2010 (the Australian dollar and the South African rand were the 3rd and 4th best performing currencies respectively during this period) which served to dampen the impact of surging dollar-denominated commodity prices.

Approximately 23% of the SA inflation basket is a measurement of food and fuel prices which are directly impacted by the currency movements. The table below demonstrates the dampening impact of the rand strength and the mounting pressure of inflation in these two commodities.

Removing the currency impact on inflation in SA, reports suggest it would be in the region of 6%, rather than the current 3.5%-4.0%. Looking ahead to the balance of 2011, a key issue when considering inflation is whether the rand is likely to continue to appreciate from current levels

In the long term, the driver of exchange rates is purchasing power parity and, on this basis, the rand is likely to weaken based on the higher rate of inflation in SA relative to our major trading partners.

In the short term, however, it appears that the driver of the exchange rate is net foreign capital flows into the local market. A net outflow, for example, in 2008, led to rand weakness during that year. More recently, we have seen substantial capital market inflows and consequent currency strength.

Interesting to note is that in 2010, 75% of total foreign inflows went into the South African bond market. As Western economies slashed interest rates from 2008 onwards in the wake of the sub-prime crisis, money flowed to higher interest rates of the emerging economies. With negative real interest rates at present in the developed communities, interest rates are likely to rise and this should lead to a decrease in the quantum of flows into SA capital markets.

This implies that in both the near and long term, mounting inflationary pressures will cease to be masked by currency appreciation. In fact, a depreciating currency will serve to accelerate local price increases.

Since 1969, inflation in South Africa has averaged 10%. More recently, however, the country has experienced a decade of lower inflation, during which it averaged 5.9%. However, when one considers that the last 10 years has been described by many commentators as the “decade of low inflation” and encompassed the “worst recession since the Second World War”, for inflation in South Africa to still have averaged nearly 6% is indicative of an economy with high inflation. In our view, a reasonable expectation for inflation over the longer term is for it to average at least 7%. Such an expectation will help investors ensure that they do not pay too much for an income stream giving them a reasonable chance of generating an acceptable level of return over and above inflation from an investment.

The outlook for investments is muted in an inflationary environment

Given this outlook, we believe that local asset classes are expensive and currently favour investment opportunities in developed markets. Local yields of bonds, property and equities are currently well below their historic averages, as well as being below acceptable yield levels, given our inflationary expectations. This suggests that income streams are too expensive, particularly if inflation is to rise in the years ahead.

Conversely, the yields on mega-cap stocks in the first world are unusually high. With dividend yields of some of the biggest companies in the world well above bond yields, equity valuations in these markets are presenting investors with a significant opportunity to generate more-than-acceptable inflation-beating returns over the next five years.

In addition, higher domestic inflation is expected to translate into a depreciating rand. Investing in offshore markets, would offer investors a hedge against a weaker currency while simultaneously affording the opportunity to diversify risk.

This release has been issued on behalf of Marriott Asset Management

For more information contact:

Marriott Asset Management:

Bronwen Barclay, Head of Marketing & Distribution on 031 765 0736 or 083 797 9979

Duggan Matthews, Investment Professional on 031 765 0705 or 071 951 8449

Shirley Williams Communications

Shirley Williams 031 564 7700 or 083 303 1663

Gillian Findlay 082 330 1477

About Marriott Asset Management

Marriott: Income Focused Investing is a differentiated asset management house that offers niche products, predominantly for the retired investor. The tag-line “Income Focused Investing” evolved as a result of the investment philosophy underpinning Marriott Asset Management.

Marriott Asset Management began as Russell & Marriott in Durban in 1862, making it one of the oldest financial services businesses in the country. The company currently has over R8-billion in assets under management, and offers a number of investment products including local and international collective investment schemes. Marriott Asset Management was acquired by Old Mutual in 2005 and now forms part of the Old Mutual Investment Group SA as an independent boutique.