SA Budget Speech - At last some good news!!!

NEWS FLASH

AT LAST – SOME GOOD NEWS!!!

Finance Minister Pravin Gordham announced during the 2011 Budget Speech that it will now be possible to buy a property up to R600 000,00 without paying transfer duties. The transfer duty exemption prior to this was R500 000,00. This revised rate structure will apply to properties acquired under sale agreements concluded on or after 23 February 2011 and will mean that the purchaser will enjoy considerable savings when purchasing a property.

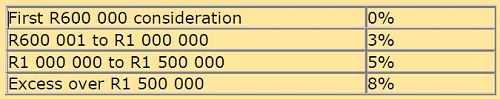

The transfer duty rates now applicable will be as follows:-

This is really a significant development as previously Companies, Close Corporations and Trusts paid an 8% flat rate of the purchase price as transfer duty irrespective of the purchase price, this made it very expensive to purchase properties in legal entities. From the 23 February 2011, Companies, Close Corporations and Trusts will pay the same transfer duty as natural persons.

In other words, natural persons and legal entities, such as Close Corporations, Companies and Trusts, having purchased property to value R600,000 from 23 February 2011 will be exempted from transfer duty. This saving amounts to R5,000 for persons and R48,000 for legal entities.

Further examples of savings:-

The increase in the threshold will give many more people the opportunity to become home owners and get on the path to wealth creation. It will also enable more property owners and investors to transfer their properties into trusts for asset protection and Estate planning purposes.

Should you require any further information with regards to the above or any other matter please do not hesitate to call us.

Courtesy: Anthony Whatmore

For further information please contact:

Anthony Whatmore Attorneys & Conveyancers

Tel: +27 (31) 563 7111

Email: [email protected]