UK Property – Knight Frank Student Accommodation Index

Total annual returns from student accommodation hit 13.5% in September 2010

Headlines: -

- This release marks the launch of the Knight Frank Student Accommodation Index - the first industry benchmark to accurately track the performance of this important asset class

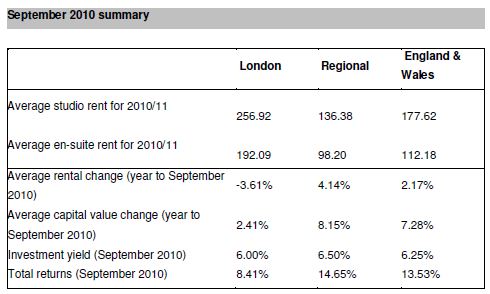

- Average rents for investment class student accommodation rose 2.2% across England & Wales in the year to September 2010

- Average rents in London fell back over the period by an average of 3.6%, whereas rents for regional cities rose by 4.1%

- Investment returns across England & Wales fell back from 6.56% in September 2009 to 6.25% in September 2010

- Current investment yields stand at 6.00% in London and 6.5% in the regions

- Total returns (income and capital value growth) stood at 13.5% in England & Wales in September

James Pullan, Knight Frank's head of student property commented:

"Student property has delivered consistently healthy returns over the past five years. The sector avoided the crash in both capital values and rentals seen in the wider commercial and residential sectors in 2008 and early 2009.

"Across England & Wales rents have continued to rise into the 2010/11 academic year (by 2.2% on average) reflecting the strong demand for accommodation from a rising student population, but also the on-going process of improvement and enhancement being undertaken by the student accommodation operators.“

"Investors are looking increasingly favourably on the sector as they are attracted by what are perceived to be the contra cyclical properties of investing in Education. Specifically investors are seeking security of income and the wider investment case offered by student property and this is demonstrated by the sharpening of yields over the past 12 months by over 30 basis points - from 6.56% to 6.25% in the 12 months between September 2009 to September 2010.

"Full occupancy is a characteristic of the sector. In the regions outside London rents have risen by around 4.1% over the last academic year. In London we have observed some pressure on the high end stock which has resulted in an overall fall of rents this year.

“The general outlook for rents is of continued pressure for annual growth with undersupply of student accommodation still a pronounced feature in most markets. In London we project a stabilisation of rents over the forthcoming year with developers targeting strategically accessible transport hubs to provide high quality accommodation at sustainable rents.”

"With total returns at 13.5% in September - the sector is continuing to deliver strong and stable performance for investors. The outlook for 2011 is extremely positive. The sector is well positioned to deliver stable and sustainable returns against a turbulent economic backdrop.

Courtesy: Knight Frank Residential Research

For further information, please contact:

James Pullan, partner, student accommodation, Knight Frank

Tel: +44 (0)20 7861 5422

Liam Bailey, head of residential research, Knight Frank

Tel: +44 (0)20 7861 5133

Alice Mitchell, commercial pr manager, Knight Frank,

Tel: +44 (0)20 7861 5168