SA Property - Mortgage advances growth unchanged

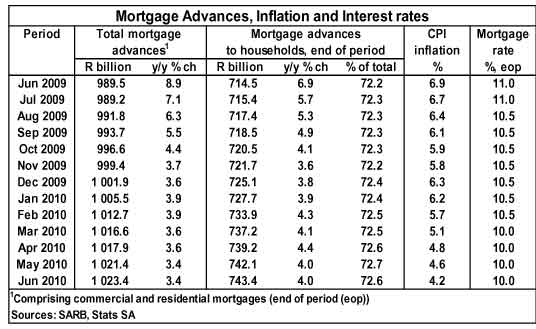

The total value of outstanding mortgage balances at monetary institutions, which includes both commercial and residential mortgage loans, increased by 3,4% year-on-year (y/y) to R1 024,4 billion in June 2010. The June year-on-year growth is unchanged from May. On a month-on-month basis, outstanding mortgage balances was up by R2 billion, or 0,2%, in June from May.

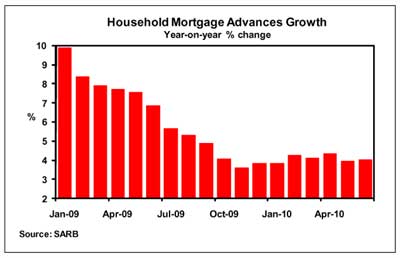

Year-on-year growth in the value of households’ outstanding mortgage balances was also unchanged at 4% in June from May. Month-on-month growth was negligible at 0,2% in June (0,4% in May). The value outstanding mortgage balances in the household sector was up by R1,3 billion to R743,4 billion in June.

Total credit extended to the household sector, including mortgage advances, was up by 4,3% y/y in June from 3,8% y/y in May. On a month-on-month basis the value of credit extended to the household sector was up by R3,8 billion, or 0,4%, to an amount of R1 061,7 billion in June.

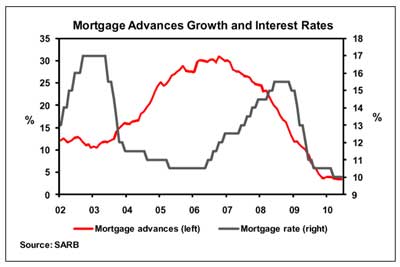

These trends with regard to household credit extension as well as household mortgage advances show that the household sector is still experiencing a fair amount of financial pressure, Data recently released by Statistics South Africa indicate that employment dropped by another 0,5% quarter-on-quarter (q/q) in the second quarter of 2010, after employment has declined by 1,3% q/q in the first quarter. Consumers’ ability to spend and take up credit will be dependent on the performance of the economy, employment, income growth, interest rates and the level of existing debt.

In view of these developments, year-on-year growth in credit extension to the household sector, including mortgage advances, is expected to remain in single digits in the second half of the year.

Courtesy: Jacques du Toit Senior Economist ABSA Bank

Disclaimer:

The information in this publication is derived from sources which are regarded as accurate and reliable, is of a general nature only, does not constitute advice and may not be applicable to all circumstances. Detailed advice should be obtained in individual cases. No responsibility for any error, omission or loss sustained by any person acting or refraining from acting as a result of this publication is accepted by Absa Group Limited and/or the authors of the material.