Global House Price Index - Top 10 rankings in Q2, 2025

European Residential Update - Europe dominates Global House Price Index, but debt clouds the outlook

October 2025

Image: Kate Everett-Allen - Head of European Residential Research

House prices

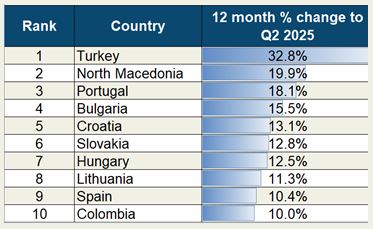

Eight of the world’s top ten hottest housing markets are European according to Knight Frank's latest Global House Price Index, which tracks mainstream property values across 55 countries and territories.

North Macedonia topped the rankings with nominal price growth of 19.9% year-on-year, followed closely by Portugal at 18.1%. Bulgaria rounded out the European podium with 15.5% gains, according to the data which tracks the annual change in residential prices to Q2 2025.

Croatia (13.1%), Slovakia (12.8%), and Hungary (12.5%) also feature prominently in the upper ranks, while Spain registers solid double-digit growth at 10.4%. The Netherlands (9.3%) and Ireland (8.0%) also post strong gains, demonstrating broad-based momentum across the continent.

What's behind the growth? Earlier rate cuts from the European Central Bank have improved financing conditions and consumer sentiment across the eurozone. Markets with buoyant economies (Spain, Portugal, North Macedonia, Bulgaria) and those where rate cuts are being passed on by high street banks are performing strongly.

Global House Price Index, Q2 2025

Top ten rankings

However, not all European markets are thriving. At the bottom of the table, France barely registers growth at just 0.3%, while Austria remains flat at 0.0%. Finland (-2.7%) posts the weakest European performance, ranking 53rd globally with an outright decline. These laggards face challenges such as weaker economic momentum and more cautious buyer sentiment despite broader monetary easing.

Debt

Debt is overtaking tariffs as the biggest concern for European politicians and consumers.

According to Eurostat, Greece, Italy, and France now have debt-to-GDP ratios of 152.5%, 137.9%, and 114.1% respectively - all far exceeding the EU's 60% target.

You only need to look at France to see the political and economic impact of such debt levels. Sebastien Lecornu resigned and was reappointed last week making him Macron’s seventh Prime Minister and the fourth in barely a year. Fiscal reform is at the root of the political paralysis.

High debt levels mean countries are hiking taxes in search of revenue:

- Portugal recently increased stamp duty for non-residents purchasing property

- Spain plans to tax non-EU homebuyers 100%

- Germany and Norway have increased the scope of their existing exit taxes and Belgium has introduced for residents transferring their tax residency abroad and realising a gain within two years

Authorities are trying to strike a balance of reducing debt burdens whilst not deterring the foreign investment Europe desperately needs to drive growth through economic expansion rather than austerity alone.

Expect more tax hikes as European governments try to plug their expansive deficits.

Borders

The European Union activated its long-delayed Entry/Exit System (EES) on 12 October 2025, replacing manual passport stamps with biometric checks across 29 countries. The six-month rollout marks a major shift toward digital border control, with full deployment due by April 2026.

At its final meeting in Tallinn, the EES–ETIAS Advisory Group confirmed that all member states are technically ready. The system will record names, passport data, facial images, and fingerprints of non-EU travellers entering or leaving the bloc.

Officials say EES will cut queues, curb overstays, and boost law-enforcement access to travel records. Spain and Germany will be among the first to activate the system at major airports. The move lays the groundwork for ETIAS, the EU’s electronic travel authorisation set to follow in 2026, signalling Europe’s transition to fully digital border management.

For non-EU nationals with second homes in Europe, the new system will tighten monitoring of short-stay limits. Frequent visitors from the UK, US, and other visa-free countries will need to track their 90-day allowance more carefully, as automated records replace manual discretion. Longer-term residency routes may gain renewed appeal as digital border compliance becomes the norm.

Courtesy: Knight Frank

Contact for Further Information:

Kate Everett-Allen - Head of European Residential Research

Knight Frank is the trading name of Knight Frank LLP. Knight Frank LLP is a limited liability partnership registered in England and Wales with registered number OC305934. Our registered office is at 55 Baker Street, London W1U 8AN. We use the term ‘partner’ to refer to a member of Knight Frank LLP, or an employee or consultant. A list of members names of Knight Frank LLP may be inspected at our registered office.