Global House Price Index - Europe dominates the leaders’ table

August 2025 - European Residential Update

Kate Everett-Allen - Head of European Residential Research at Knight Frank

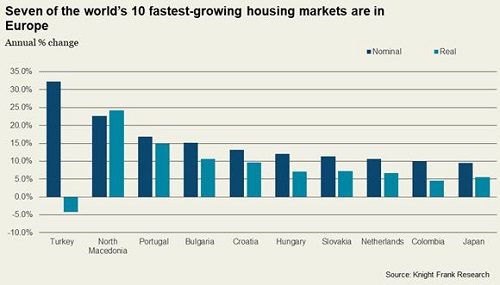

Knight Frank’s Q1 2025 Global House Price Index, which tracks mainstream house prices across 55 countries and territories, reveals that Europe is home to seven of the ten fastest-growing housing markets globally.

North Macedonia was the standout performer, recording 22.6% nominal growth, outpacing many established markets. Portugal held the region’s second spot with 16.9% nominal annual growth, followed closely by Bulgaria (15.1%) and Croatia (13.1%).

Improved eurozone sentiment, lower rates, tourism demand, foreign investment, and a low starting base are driving growth - especially in Central and Eastern Europe.

Spain, in 12th place, also posted strong annual growth of 9%. However, France and Austria are notable laggards - both recorded just 0.4% nominal growth, with real growth slipping into negative territory.

Spain: Foreign demand strengthens

The IMF forecasts Spain’s GDP will grow by 2.5% in 2025, more than double the expected eurozone average. This follows a robust 3.2% expansion in 2024, underpinned by strong services exports - especially tourism - alongside rising labour force participation and elevated immigration.

This strength is reflected in Spain’s housing market, where foreign appetite has hit record highs.

Taking the first half of 2025, 33,134 homes were purchased by international buyers - 15% more than in the same period last year and 50% above the long-term average - making it the strongest first half of the year for foreign demand on record.

Local demand was equally buoyant, with 146,956 domestic transactions, up 18% year-on-year and 35% higher than the decade average.

But the buyer mix is shifting. New data from Spain’s Land Registry reveals that whilst the British remain the largest group with 1,874 purchases, followed by German sales (1,590), however, the standout growth story is the Netherlands, where purchases surged 40% year-on-year, while Belgian demand rose 20%. Of the nationalities tracked, only Russian transactions fell, declining by 19%.

Monetary Easing: A fresh tailwind for Europe’s housing markets

The European Central Bank has now delivered eight consecutive rate cuts, with forecasts pointing to a base rate of just 1.75% by year-end.

This sharp shift makes euro-denominated borrowing significantly more attractive than debt in the UK or US - an important competitive edge for leveraged buyers.

Lower rates are already feeding through into mortgage markets. In Spain and Portugal sub-3% fixed-rate deals are reappearing, providing renewed support for prime housing segments.

Still, risks remain. The new EU–US tariff deal has eased tensions, but lingering levies and weaker exports mean trade uncertainty could yet slow the pace of rate cuts.

For now, however, the combination of cheaper credit and relative currency strength, which reinforces investor confidence and attracts cross-border capital, is creating a more favourable backdrop for European luxury property.

If you’re interested in these themes and the movement of wealth into Europe’s top locations, sign up for our European Lifestyle Report which will be launching in September.

Courtesy: Knight Frank

FOR FURTHER INFORMATION, CONTACT:

Kate Everett-Allen - Head of European Residential Research