SA Budget 2024 - Your Tax Tables and Tax Calculator

How much will you be paying in income tax, petrol and sin taxes? Use Fin 24’s four-step Budget Calculator here to find out.

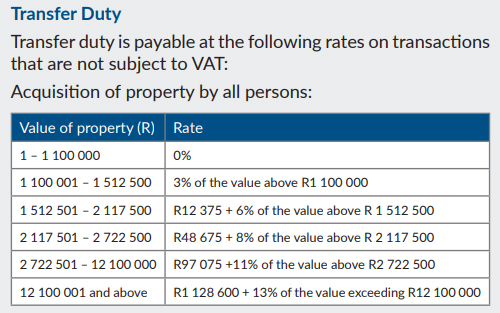

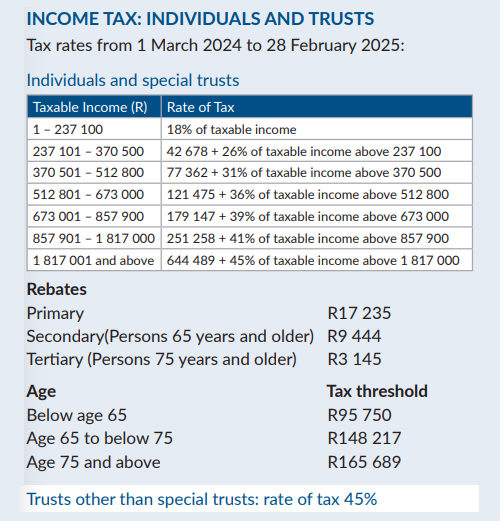

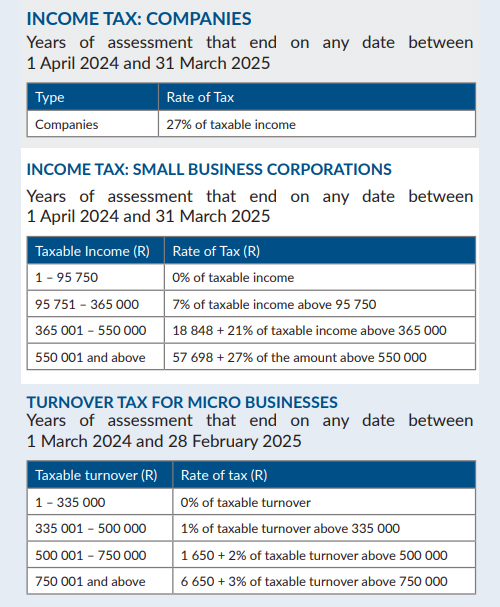

The unchanged transfer duty and tax tables, with a note on fiscal drag

Unchanged from last year, so taxpayers can breathe a sigh of relief that rates have not been increased as many forecasters had feared.

But the other side of the coin of course is that there is no inflation adjustment to the rates this year, which means that “fiscal drag” will leave you paying more tax if your inflation-linked increase pushes you into a higher tax bracket. Effectively, the buying power of your net income will fall. Plus if your property has increased in value into a higher threshold, your buyer will pay more transfer duty.

Source: SARS

Source: SARS

Source: SARS

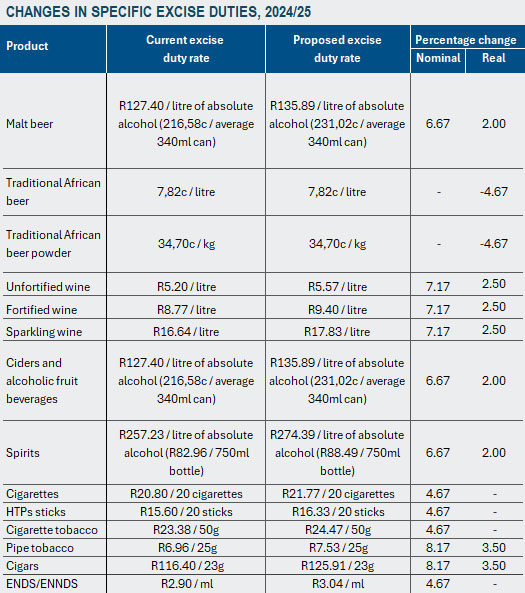

“Sin taxes” up – the details

Source: National Treasury

Retirement funding and the “two-pot” reform proposal

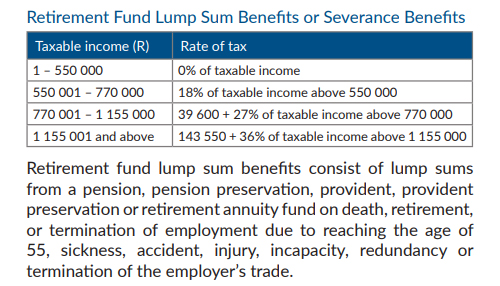

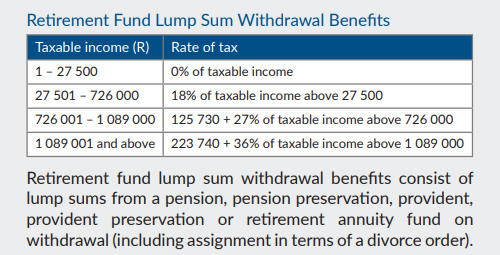

Source: SARS

Source: SARS

The proposed “two-pot” retirement reform: Per National Treasury: “Early access to retirement funds – “The two-pot retirement system will allow retirement fund members to make withdrawals from their retirement funds while they are still active members, so members need not resign to access part of their retirement benefits. ... This reform is proposed to come into effect on 1 September 2024. The National Treasury aims to finalise the legislative process rapidly in the next few months to ensure that industry and regulators can prepare for implementation. Policy research and engagement continues on the outstanding auto-enrolment, mandatory enrolment and consolidation retirement reforms.”

The proposals and their tax implications are complex and subject to change, but currently provide for a one-off withdrawal of up to R30,000 on implementation, and thereafter annual “savings withdrawal benefits”.

Provided by Anthony Whatmore & Company

© DotNews. All Rights Reserved.

Disclaimer

The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.