UK Property - House prices fall again as expectations in financial sector slump

Knight Frank/Markit House Price Sentiment Index (HPSI)

House prices fall again as expectations in financial sector slump

Key headlines for January

- UK house prices are perceived to have fallen again in January, for the 19th consecutive month

- The rate of decline has eased over recent months

- Property values will be broadly stable over coming year

- Sharp deterioration in house price expectations among those working in the financial and business services sector

Change in current house prices

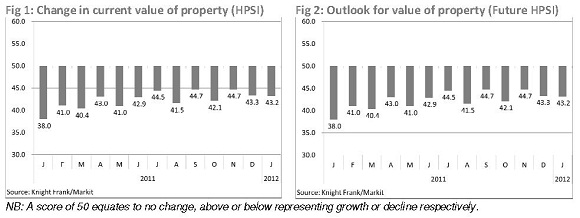

Knight Frank/Markit’s January House Price Sentiment Index (HPSI) shows that the rate of decline in house prices was similar to that in December. Some 5% of households said that the value of their home had risen since December, while around 19% reported a fall. The resulting HPSI figure of 43.2 is down from 43.3 in December, but well up from the reading of 38 recorded in January last year.

Any figure under 50 indicates that prices are falling, and the lower the figure, the steeper the decline.

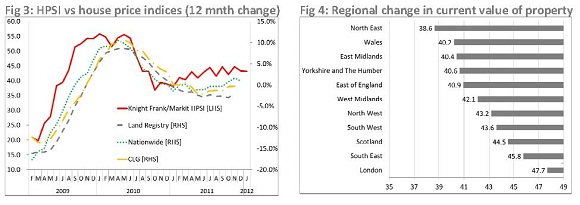

Property values were perceived to have fallen in all 11 regions this month, according to the survey of 1,500 households. The sharpest declines were in the North East (38.6) and Wales (40.2). The least pronounced falls were in London (47.7), but this is still the lowest reading for the capital in three months.

There was a notable deterioration in sentiment among those who own their own homes outright. The HPSI reading for this group was 36.4, down from 40.8 in December, and matching the lowest reading in eight months. Those working in the private sector (44.9) were slightly more upbeat than those working in the public sector (42.1) about the rate of decline in their house prices.

A lead indicator

Since the inception of the HPSI, the index has been a clear lead indicator for house price trends. Figure 3 shows that the index moves ahead of mainstream house price indices, confirming the advantage of an opinion‐based survey which provides a current view on household sentiment, rather than historic evidence from transactions or mortgage market evidence.

Outlook for house prices

The future HPSI, which measures what households think will happen to the value of their property over the next year, remained below, but close to, the 50 no-change mark in January for the second month at 49.3, down from 49.7 in December. This is the first time the index has remained below 50 for more than a month since May last year.

Regional outlook

Households in only three of the 11 regions expect the value of their homes to rise over the next year: London (57.8), the South East (54.3) and Scotland (52.9). Prices are expected to decline in ll other regions, with the biggest falls anticipated in the North East (41.7) and Wales (42.6).

Household variations

Sentiment about future house price movements has dropped sharply among those working in finance and business services. January’s reading of 43.1 is down from 58.7 in December and marks the lowest reading since this index began in April 2009 – just as the recession started to ease.

It is also the lowest reading across all sectors in January, reversing the trend over the last six months when workers in this sector expected the biggest rise in house prices.

However there was a surge in optimism over house prices among those working in the construction sector, with a reading of 55.4, up from 44.5 in December.

Mortgage borrowers (51.6) and tenants (50.3) expect prices to rise over the next year, but those who own their home out-right (47.2) expect a fall in prices.

The biggest deterioration in expectations is among those who live rent-free at home. January’s reading of 43.9 is down from 56.1 in December, and is only the second time the reading has been below the 50 no-change mark in the last eight months.

Analysis

Gráinne Gilmore, head of UK residential research at Knight Frank, said: “There is little New Year cheer among households this month, perhaps reflecting the wider economic uncertainty throughout the UK, with fears that the country may be back in recession only compounded by alarming unemployment figures released earlier this week.

“The sharp reversal in sentiment about future house prices among those working in finance and business services is also evidence of the toll being taken on that sector at present as many banks cut thousands of jobs. It is striking that this sudden fall in confidence coincides with the traditional ‘bankers’ bonus’ season.

“The regional differences in expectations for house prices also highlight the North-South divide which is becoming ever more evident in the housing statistics. With the exception of Scotland, where households also expect prices to bounce back over the next year, households in London and the South East are far more upbeat than those elsewhere in the country”.

Tim Moore, senior economist at Markit, said: “The verdict from households across the UK is that there will be little movement in their property values during 2012, with exactly half expecting no-change and only slightly more anticipating a fall than a rise. Forecasts of roughly stagnant house prices are symptomatic of the caution prevailing about local job market conditions and the gloomy economic news spreading from the euro area.

“People working in finance and business services saw a steep reversal in their house price expectations during January, highlighting the sensitivity of property value sentiment to labour market developments. Although the HPSI survey has a relatively short history, house price sentiment in this industry has so far been a useful bellwether for future developments in the wider market.”

Courtesy: Knight Frank and Markit

For further information, please contact:

Knight Frank

Rosie Cade

[email protected]

+44 20 7861 1068

Gráinne Gilmore, Head of UK Residential Research

[email protected]

+44 20 7861 5102, +44 7785 527 145

Markit

Rachel Harling, Corporate Communications

[email protected]

+44 20 7064 6283

Chris Williamson, Chief Economist

[email protected]

+44 20 7260 2329